Retracement vs Reversals: What is the Difference?

When the market goes down, you must hear a trader say, “The market is “retracing.” This just means the price is taking a little upward break after a drop, like a quick pause before it continues to go down.

But often common traders confuse ‘reversal’ with ‘retracement’. Now, reversal is a bigger picture that essentially can lead to change in overall sentiment of traders. It shows that this time, the market is changing direction for real.

In this blog, we would learn the basics concepts of both retracement vs reversal and find out what makes both different from each other. So let’s ride in.

Table of Contents

ToggleWhat Is Retracement?

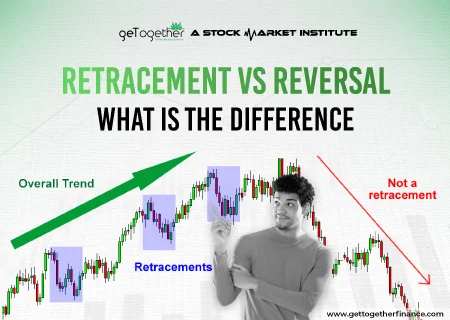

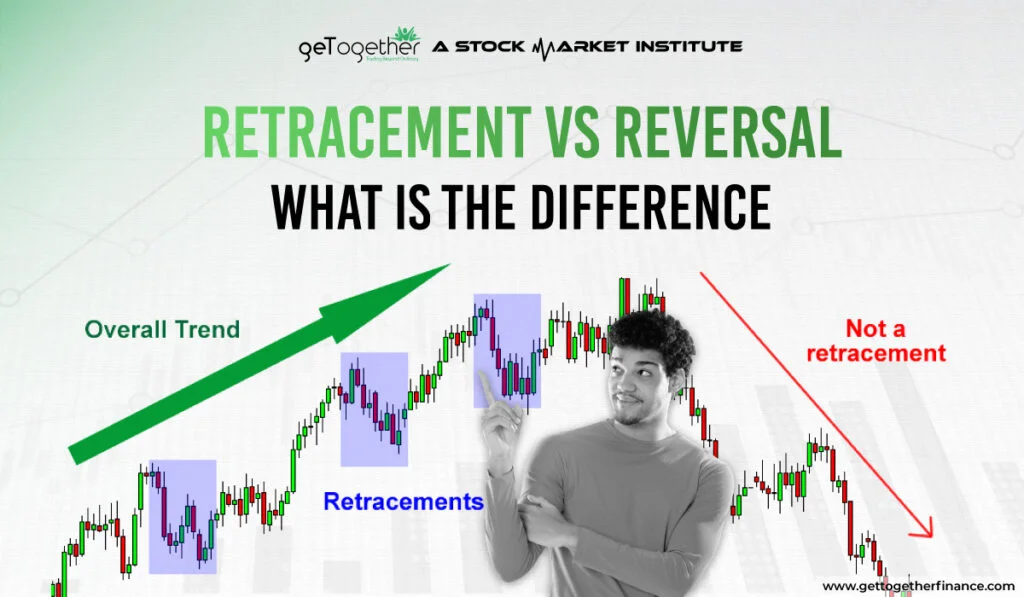

Retracement is a temporary break, pause, or reversal in the direction of a stock or asset within a larger trend.

Let’s take an example to better explain it. Suppose you go to mountains for a long hike. Now, during your journey, sometimes you’ll need to stop, and catch your breath. Or sometimes, you may even step back a bit before continuing upward.

That’s exactly what a retracement is. A small, temporary hold or step back that doesn’t change the bigger picture.

For traders, the main thing to remember is that even though the price goes down, it’s still moving in the same long-term direction.

Fun Facts: Did you know that retracements often happen around important Fibonacci levels? Hey, what a coincidence, or is it?

In an uptrend, for example, prices might pull back, but they usually bounce back without dropping below the last low point. This pattern of “higher highs and higher lows” shows the trend is still strong, just pausing momentarily before moving up again.

Traders often look for these brief pauses to enter a position or adjust their trades. So, while retracements may look like a dip, they’re often an opportunity.

What Are Reversals?

‘Reversal’ as the name says it all – reversal put a pause on an ongoing trend and push its whole vibe in the opposite direction altogether.

A reversal is when the price of something, like a stock, changes its main direction. For instance, if a stock has been going up for a while, a reversal would mean it starts going down—and it’s likely to stay that way for some time.

It can happen fast or slowly, over days, weeks, or even longer. Sometimes you’ll see small price drops or rises that don’t last; these aren’t true reverse movement. The tricky part is figuring out whether a small move is just a temporary blip or the beginning of an actual case.

Many technical tools and indicators such as Support and Resistance Levels, M averages (MA), and trendlines can help traders spot opposite movement in price trends. For day traders, intraday reversal—changes that happen within a single day—are very important. On the other hand, longer-term investors may pay more attention to changes that happen over several months or quarters.

Difference Between Retracement vs Reversal

We’ve all been there—watching a stock we own drop in price and wondering if it’s reversal of trend or just market retracing. The enigma between both words can confuse the trader, only to see losing a big opportunity of a chunk of money.

Mainly the difference between retracement and reversal lies in how long and significant the price change is. But here a few aspects that sets them apart:

Definition of Concept

- Retracement: A short-term, temporary movement against the main trend. It’s like the marker is taking a small “pause” in an overall trend (up/down).

- Reversal: A long-term change in the trend direction. This hints that the end of the current trend and the beginning of an opposite one.

2. Time Duration

- Retracement: Retracement happens for a short period, maybe for a few minutes, hours, or days depending on the chart’s timeframe.

- Reversal: It’s like a season, lasting much longer than retracement. Once the trend takes a reverse, it often continues in the new direction for weeks, months, or even longer.

3. Effect on the Main Trend

- Retracement: Mostly, most trends stay unaffected during the retracement. If the main trend is going up, a retracement will be a quick drop down, but the trend will continue upward afterward.

- Reversal: It changes the main trend and whole market sentiment. For example, if the trend was upward, a reversal would shift it downward, creating a new long-term direction.

4. How It Looks on a Chart

- Retracement: It appears as a minor movement against the trend if seen from a distance. For example, in an uptrend, retracing prices shows as a small downward move but doesn’t break key support levels.

- Reversal: It mostly breaks major support or resistance levels, signaling a more permanent change in direction.

5. Trading Strategy

- Retracement: Traders often look this as opportunities to enter the trend at a better price. For example, if they believe a stock will keep rising, they might buy during a small drop.

- Reversal: Reversal can stay for long, hence it needs a different strategy. When a reversal is spotted, traders might exit positions in the current trend and consider trading in the opposite direction.

Example for Understanding:

If an example can set everything better – imagine a stock has been steadily rising for a few months (uptrend):

- A retracement might look like a quick drop in price for a few days, but then it picks up and continues rising. It’s a “breather” in the main uptrend.

- A reversal would mean the stock stops rising and starts a steady fall, creating a new downtrend.

Retracement vs Reversal

Here is a quick table that simplify the key differences between retracement and reversal:

| Aspect | Retracement | Reversal |

| What It Is | A temporary dip in price while the overall trend is still going up or down. | A complete change in direction, meaning the price is likely going to keep moving the opposite way. |

| How Long It Lasts | Usually lasts a short time, like a few days to a couple of weeks. | Can last much longer, often weeks or even months. |

| Size of Price Change | Involves smaller price changes against the main trend. | Involves big price changes that show a strong shift in direction. |

| Volume of Trading | Usually has lower trading volume; people may just be taking profits for a short time. | Often has high trading volume, showing lots of selling and strong market reactions. |

| Chart Patterns | Shows less dramatic changes on charts; may look like indecision or small pullbacks. | Shows clear patterns like head and shoulders or double tops/bottoms that indicate a trend change. |

| Support and Resistance | Prices often stay above support levels during retracements. | Prices may break through important support or resistance levels, showing a stronger change in sentiment. |

| What to Do When You See It | A chance to buy at better prices before the trend continues. | A sign that you might need to sell or change your strategy because the trend has changed. |

| Aspect | Retracement | Reversal |

| What It Is | A temporary dip in price while the overall trend is still going up or down. | A complete change in direction, meaning the price is likely going to keep moving the opposite way. |

Conclusion

In a nutshell, retracement may give an impression of a small price pullback. But alternatively, reversal is not just about one Retracement, but is made of multiple small retracements. Understanding this difference between retracements and reversal is super important for an investors for making better trading decisions.

Via learning how to spot these patterns, investors can avoid making rushed decisions, such as selling a stock too soon or holding on for too long. You can use multiple methods such as trendlines, moving averages, or Demand-Supply Dynamics to identify between both and make wiser decisions.

FAQs

How long does a retracement last?

Retracements usually last for a short time, often just a few days to a couple of weeks.

How long does a reversal last?

Reversal can last much longer, sometimes weeks or even months, as they indicate a new trend.

How do I use Fibonacci levels for retracements?

You can use these levels (like 38.2% or 61.8%) to find where the price might bounce back up after dropping temporarily.

Do all trends have retracements?

Most trends will experience some form of retracement as part of their natural movement, but not every trend will have major ones.

Facebook

Facebook Instagram

Instagram Youtube

Youtube