What is Return on Assets(ROA)?

Introduction

Financial parameters and metrics like ROA serve as essential tools for gauging the financial health and performance of the company. Investors, managers, and stakeholders significantly monitor how well the company is doing and where the scope of improvement lies with the help of financial metrics. Some of the most common and widely used financial metrics include revenue, profit margins, and return on equity. Among all these, Return on Assets (ROA) serves as an excellent indicator in knowing a company’s efficiency in generating profits using its own assets.

A good and efficient ROA is heavily appreciated by investors as it indicates that the company is utilizing its resources and assets well. Return on Assets is calculated by comparing net income to total assets, it reveals the profitability generated from each Rupee of assets owned by the company. Hence, ROA is an important metric. Understanding ROA efficiently helps investors in making informed decisions, managers optimize operations and grow and expand the business sustainability.

Understanding Return on Assets (ROA)

As mentioned earlier, Return on Assets (ROA) is a financial metric that gauges how much profit a company is making in relation to its overall assets. In the simplest language, it answers the question: “How much profit is the company making with the help of what it owns?”

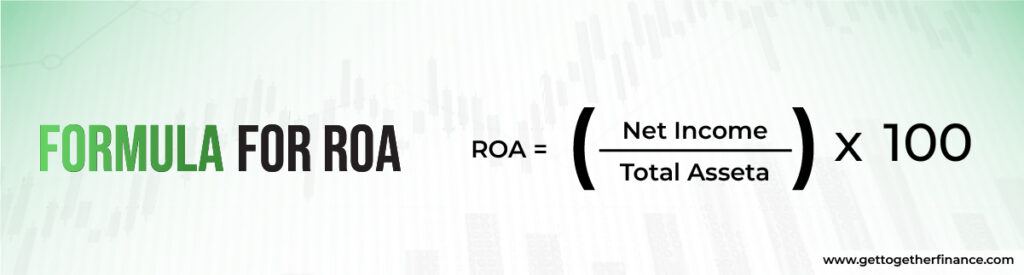

Formula for ROA

The formula for calculating ROA is straightforward:

Here’s how it works:

Net income, which can be taken from the company’s income statement, represents the total profit after excluding all expenses.

Total assets, which are listed on the balance sheet of the company, include everything the company owns, such as cash, property, inventory, and machinery.

By dividing net income by total assets and multiplying it by 100, you get the return on Assets percentage. This percentage indicates how well the company is utilizing its assets to generate profit, providing a clear snapshot of operational efficiency.

Interpreting ROA

Return on Assets (ROA) measures how efficiently a company uses its assets to generate profit. A higher ROA indicates more effective asset utilization, showcasing the company’s ability to convert investments into net income.

What is a Good ROA

We already studied that good ROA is an indicator of the efficiency of the company in utilizing its resources. But, what is a good ROA? Generally, the higher the ROA, the better the financial health, as it signifies greater efficiency and profitability of the company.

However, the actual consideration of “good” ROA can vary significantly based on the business model and differ on an industry basis too. For instance, a manufacturing company has a different ROA as its sole work is based on its valuable assets for producing goods. Whereas, the Return on Assets of a software company will differ as it works on minimal physical assets. Generally, an ROA of 5% or higher is considered good, but this can vary across different sectors.

Also Read: Return on Equity

ROA Benchmarks by Industry

ROA benchmarks vary from company to company because every company belongs to a specific sector that has different requirements and utilization rates of physical assets. Here are some general benchmarks:

Technology Sector: Tech companies generally have higher ROA which exceeds the 10% mark also, this is because of the low asset-based working structure.

Retail Sector: Here, Return on Assets generally ranges from 5%-10% based on retail management and sales efficiency.

Manufacturing Sector: Since high capital is invested in assets in the manufacturing sector, the ROA is generally low ranging from 2%-5%.

Financial Sector: Banks and other financial institutes generally have low ROA up to 3% as their majority assets are loans and security documents.

Understanding these benchmarks helps in evaluating a company’s performance relative to its industry peers.

Importance of ROA

Measuring Profitability

The company’s profitability can be gauged with the help of ROA. The ratio of net income with total assets gives ROA which eventually reveals the number of profits a company generates from utilizing its assets and resources.

ROA metric significantly allows stakeholders, managers, and investors to gauge whether the company’s asset and resource bag is being used effectively to produce target profits. The higher Return on Assets signifies that the company follows a great business model and is generating increased profit per rupee of assets, it is also a good sign for future expansion and growth.

Investors take good ROA as an excellent signal for the profitable future of the company as the company is running a profitable business model and growth opportunities are automatically increased in this situation.

Efficiency in Using Assets

Higher ROA signifies efficient asset utilization, it shows that assets of the company—like equipment, property, and inventory— are put to good use and their productivity is maximized to drive profit. This aspect of Return on Assets is utterly useful for companies whose business model is based on investment on substantial investments in fixed assets. Here’s how good ROA improves the efficiency of assets:

- Efficient Management: The company with a higher ROA is not only just generating enormous profits but also maximizing the value derived from the investments made in fixed assets. On the contrary, the lower ROA indicates low or underutilization of assets or inefficiencies in business operations.

- Performance Measurement: Having a clear outlook on the Return on Assets of particular quarters can help managers know from where the maximum productivity is coming. This helps in filtering out the best assets and knowing the scope of improvement.

- Investment Decisions: When the loopholes in the economic development are found, it becomes easier for managers to know where to make informed investment for better profits and improved ROA.

Thus, ROA is a comprehensive indication of both profitability and operational efficiency, making it invaluable in measuring a company’s financial health.

Factors Affecting ROA

1. Asset Utilization: Efficient asset utilization is utterly required for higher and improved ROA. This shows how effectively the assets are being used for generating revenue and increasing profits.

Companies that have invested a heavy amount in assets and are utilizing it well to have great turnovers in a financial year have a greater ROA. This is because they can generate more revenue per unit of asset investment.

Efficiently optimizing the management of inventory, improving the process of production, and enhancing sales efficiency are helpful strategies to amplify sales and consequently Return on Assets.

2. Profit Margins: Gross profit margins and net profit margins directly impact the ROA of the company. The increased profit margins indicate that the company is generating from its sales, this positively impacts the ROA, eventually attracting more investors. The profit margins can be improved with the help of cost management, cutting of unnecessary and underutilized assets, and smart pricing strategies, which will eventually enhance the Return on Assets.

3. External Economic Factors: Factors such as interest rates, inflation and market demand and supply forces highly influence a company’s ROA. Sudden economic volatility or disastrous downturns can lead to reduced consumer spending which eventually impacts a company’s sales and profits, thereby affecting ROA. Companies need to have an agile business model to adapt to the changing economic environment. This will mitigate the impact of external factors on Return on Asset.

Limitations of ROA

Different Companies Have Different Assets: One significant limitation of ROA is that it does not consider the varied asset structure across the companies of different sectors. Companies that have a manufacturing business model have lower ROAs compared to those in the service based sector. But this doesn’t imply that the profits of manufacturing firms may be less. For a better comparison, companies in the same sector should be studied. Comparing the Return on Assets of companies from different sectors is not reliable.

Depreciation Factor: The depreciation factor is completely ignored in ROA calculation. This skews the comparison between new and old assets. Furthermore, it ignores off-balance-sheet assets and liabilities, which may provide an imperfect view of a company’s underlying asset base and performance.

Misleading Interpretations: Return on Assets mostly misleads interpretations for investors if used without any strong study and analysis. For example, a high ROA might signify efficient asset use, but it may also be the result of low asset investment rather than efficient asset utilization.

Not reflecting poor performance: A low ROA does not necessarily signify the poor performance of the company; it could also be the result of a strategic choice to invest heavily in assets for long-term growth. As a result, ROA must be used in conjunction with other financial measures to provide a complete picture of a company’s success.

Overlooking Debt: ROA does not consider the debt a company has. A company with a high level of debt may have a high Return on Asset, but it may also be facing substantial financial risks.

Conclusion

To summarize, Return on Assets (ROA) is an important financial indicator that assesses a company’s efficiency in using its assets to generate profits. Understanding ROA requires knowledge of its definition, calculation, and interpretation, as well as industry benchmarks and factors influencing it, such as asset utilization, profit margins, and external economic conditions. While ROA is extremely useful for analyzing profitability and operational efficiency, it is critical to be aware of its limitations and the possibility of erroneous interpretations when used alone.

Finally, ROA provides critical insights into a company’s financial health, enabling investors and managers to make informed decisions. By integrating Return on Assets with other measures, stakeholders can get a more complete picture of a company’s performance and strategic potential.

FAQs

What is considered a good ROA?

A good ROA often suggests that assets are used efficiently to generate profits. Typically, a ROA of 5% or greater is considered desirable, but this metric varies greatly among businesses. For example, technology companies may have ROAs that reach 10%, whereas manufacturing firms may consider 2-5% acceptable.

How can a company improve its ROA?

A corporation can increase its Return on Asset by maximizing asset utilization and profit margins. This can be accomplished by improving inventory management, optimizing production processes, controlling costs, and using strategic pricing. Furthermore, focusing on key assets while eliminating underutilized or non-essential assets will assist increase ROA.

Why does ROA vary across different sectors?

Return on Asset varies per industry due to variances in asset structure and business model. Manufacturing businesses, for example, make significant capital investments in machines and buildings, resulting in lower ROAs than technology companies, which typically have less physical assets and larger profit margins.

Can ROA be misleading?

Yes, ROA can be misleading when used in isolation. A high ROA may suggest limited asset investment rather than effective asset utilization, whereas a low ROA may not necessarily indicate bad performance but may reflect large investment in long-term assets. As a result, ROA should be used in conjunction with other financial measures to conduct a thorough study.

How often should ROA be calculated and reviewed?

Return on Asset should be measured and reviewed on a regular basis, usually quarterly or annually, to monitor a company’s success over time. Regular monitoring enables you to discover patterns, evaluate the impact of strategic decisions, and make appropriate modifications to increase asset utilization and profitability.

Instagram

Instagram