Revenue and Profit: What’s the Difference?

Table of Contents

ToggleOverview

Whether you’re a career-oriented professional, entrepreneur, or business owner, knowing the fundamental concepts of accounting is vital to truly understanding your financial health.

Misunderstood as pieces of the same clothes, both are cut and shaped differently, telling a completely different story despite coming from the same number.

Both revenue and profit are crucial metrics for gauging a company’s financial health, but they represent distinct financial concepts. This e-paper dives deep into the key difference between revenue and profit by unrolling learning its definitions. The blog will further explore how to calculate revenue to profit, and what is its significance for businesses and investors.

So without further ado, let’s begin.

What is Revenue?

Revenue, also known as sales, refers to the total amount of income a company generates from its core business activities. It briefly includes income from selling goods, offering services, or any other source directly related to the company’s primary function.

How to Calculate Revenue?

Here’s the formula for calculating revenue:

Formula of Revenue = Units Sold x Price per Unit (1)

For instance, if a bakery sells 100 cupcakes at ₹20 each, its revenue for that day would be ₹2000 (100 cupcakes * ₹20/cupcake).

On the other hand, income is not akin to revenue, as a person or business can have multiple income sources, despite the main service/product selling of a company. For instance, income sources can be from investments or subsidiaries.

Also Read: Net Asset Value

What is Profit

Profit, often referred to as net income or the bottom line, reflects the actual financial gain a company earns after accounting for all its expenses. It shows the money remaining after all the costs associated with running the business are deducted from the revenue.

How to Calculate Profit

Here’s the formula for calculating profit:

Formula of Profit = Revenue – Total Expenses

Let us take the same bakery example. Suppose the bakery spends ₹75 on ingredients, ₹25 on rent and utilities, and ₹50 on wages for the day. Its total expenses would be ₹150 (₹75 + ₹25 + ₹50). Therefore, the bakery’s profit for the day would be ₹50 (₹200 revenue – ₹150 expenses).

On the other hand, gross profit is what you get when you take your total revenue and subtract the cost of goods sold (COGS). COGS covers all the direct costs of making the products you sell, like materials and labour.

Now, operating profit is the next step. You take your gross profit and subtract all the other expenses that come with running the business, like rent, utilities, and payroll.

So gross profit is your revenue after deducting production costs, and operating profit is what’s left after covering all other business expenses.

Although they look alike, there is a fine difference between revenue and profit that investors or businesses often overlook. But where is this fine line lies:

Key Difference Between Revenue and Profit

As we discussed the basic understanding of revenue and profit, it is also crucial to understand the fine line between both. The difference between revenue and profit seems like a hunch but can be a huge deal if the depth between both numbers gets wider. Here let’s understand it by segregating it depending on different factors:

Definitions of Revenue & Profits

Revenue is the total amount of money a business earns from its operations, usually from selling goods or services. However, profit is what’s left after all expenses are subtracted from revenue. It’s often called the bottom line, as it’s the final figure after all calculations on the income statement. There are different types of profit, such as gross profit, operating profit, and net profit.

Measurement of Financial Health

The key difference between revenue and profit lies in the measurement of financial health. High revenue shows strong sales and customer demand. It shows how well the company is generating income from its core activities. However, profit shows how efficiently a company is managing its costs. Even with high revenue, a company can struggle if its expenses are too high. Profitability indicates the company’s ability to sustain its operations and grow.

Business Decisions and Strategies

Businesses might aim to increase revenue through sales growth, market expansion, or promotional campaigns. However, these strategies might involve higher costs, impacting profit. Whereas strategies to boost profit often involve cost reduction, improving operational efficiency, or pricing strategies.

Investor Perspectives

Investors look at revenue to ensure market demand and growth potential. Consistent revenue growth can attract investors even if the company is not yet profitable. However, profit is important for investors as it shows the company’s ability to generate returns on investment. Profit margins help investors understand how effectively the company converts revenue into profit.

Sustainability and Growth

While increasing revenue is crucial for business growth, it must be sustainable. Rapid revenue growth without a focus on profit can lead to financial instability. Contrary, sustainable profit growth is vital for long-term success. It allows businesses to reinvest in their operations, pay dividends, and weather economic downturns.

Revenue vs Profit

Here is a brief table that shows the key difference between revenue and profit in simplified way:

| Feature | Revenue | Profit |

| Definition | Total income from core business activities | Money remaining after deducting expenses from revenue |

| Formula | Units Sold x Price per Unit | Revenue – Total Expenses |

| Focuses on | Income generation | Financial gain after accounting for expenses |

| Importance | Indicates sales volume and growth potential | Indicates financial health and sustainability |

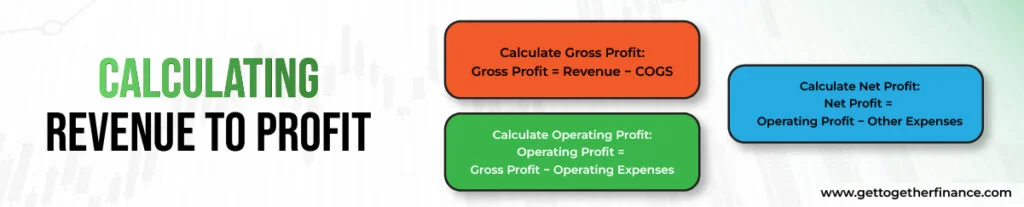

Calculating Revenue to Profit

Let’s use an example to show how to calculate revenue to profit:

Example Scenario:

- Total Revenue (Sales): ₹10,00,000

- Cost of Goods Sold (COGS): ₹4,00,000

- Operating Expenses: ₹2,00,000

- Other Expenses (Taxes, Interest, etc.): ₹1,00,000

Step-by-Step Calculation:

Calculate Gross Profit:

Gross Profit = Revenue − COGS

Gross Profit = ₹10,00,000 − ₹4,00,000 = ₹6,00,000

Calculate Operating Profit:

Operating Profit = Gross Profit − Operating Expenses

Operating Profit = ₹6,00,000 − ₹2,00,000 = ₹4,00,000

Calculate Net Profit:

Net Profit = Operating Profit − Other Expenses

Net Profit = ₹4,00,000 − ₹1,00,000 = ₹3,00,000

Key Points:

- Revenue is the starting point, showing the total sales income.

- Gross Profit shows how much amount is left after deducting direct costs (COGS).

- Operating Profit shows the earnings after accounting for operating expenses.

- Net Profit is the final profit after all expenses, including taxes and interest, are subtracted.

Conclusion

Understanding the difference between revenue and profit and learning their calculations are vital skills for any business owner or entrepreneur. Revenue offers a basic understanding of your sales volume, but profit is the true indicator of your financial health and sustainability. By focusing on strategies that improve your profit margins, you can ensure your company’s long-term success. Remember, a high-profit company is a financially healthy company, positioned for sustainable growth and the ability to reinvest in future financial journeys.

FAQs

What is the difference between revenue and profit?

The critical difference between revenue and profit lies in the inclusion of expenses. Revenue simply reflects the total income generated, while profit considers the cost of generating that income. A company can have high revenue but low or even negative profit if its expenses are excessive.

Is revenue and profit the same?

No, revenue is the total income from sales before expenses and is often referred to as the u0022top lineu0022 because it appears at the top of the income statement. Whereas profit is the remaining income after all expenses have been deducted and is known as the u0022bottom lineu0022 because it is the final figure on the income statement.

Which technique has been used to determine the relationship between cost, revenue, and profit?

The Cost-Volume-Profit (CVP) Analysis is used to determine this relationship by assessing how changes in costs and volume affect profits. It includes break-even analysis, calculating contribution margin, target profit analysis, and margin of safety.

Which metric is more important: revenue or profit?

Profit is generally considered a more significant indicator of a company’s financial health and sustainability. However, revenue growth can also be crucial, especially for startups establishing their market presence.

What is the difference between gross profit and net profit?

Gross profit reflects the money remaining after deducting the cost of goods sold (COGS) from your revenue. Net profit is the final figure after subtracting all expenses, including operating expenses, taxes, and interest.

Why is it important to track both revenue and profit?

Monitoring both metrics offer a complete picture of your business’s financial health. Revenue growth signifies increasing sales and customer demand, while profit shows how effectively you’re managing your costs and generating financial gain.

Facebook

Facebook Instagram

Instagram Youtube

Youtube