Understanding Share Delisting: An Overview

Overview

Share Delisting is removing shares from the stock exchange, referring it is no longer available for the public to trade. Usually, it is done when a company declares bankruptcy or is in huge debt that it can’t pay its investors back.

There are many reasons that voluntarily or involuntarily delist certain shares from the exchange. There are certain listing requirements that the company needs to follow for seamless trading, if the company doesn’t tick all of these boxes’ requirements, then the SEBI issues the issue for share delisting.

In this blog, we’ll study the delisting of shared work and why it is needed in certain conditions.

What is Share Delisting?

Share delisting refers to the condition when a company’s shares are removed from the stock exchange and are no longer tradeable. This usually happens when the listed company is unable to meet the requirements listed by SEBI and decides to go private. When a company’s shares are delisted, it complies that no traders, investors, or any other stock market participants buy, sell, or hold those stocks on that stock exchange.

This can happen for various reasons, such as if the company is not meeting financial standards, facing bankruptcy, or if it’s being acquired by another company. For the existing shareholders, it usually impacts negatively. The actual amount of their investments is hard to delist. But, it is worth noting that delisting isn’t always done in bad conditions, sometimes it can be a strategic move by the company to reframe and re-adjust its operations and focus. However, investors need to stay informed about the reasons behind delisting and what it means for their investment.

How Delisting is Done?

Delisting is not a single-day basis, instead, it is a strategic and well-planned move, which can be studied as follows:

- Board Decision: The company’s board members look into the current situation of the company. They decide to delist the shares if the company is unable to meet financial requirements, an acquisition or merger is happening, the company is declaring bankruptcy, etc.

- Notification to Exchange: The next step is when the company informs the stock exchange voluntarily about the share delisting of the formal notice that companies meet all official requirements in these circumstances.

- Shareholder Notification: Following, the existing shareholders are informed about the share delisting through media channels, press releases, or any other form of distribution channel.

- Public Announcement: Next, the company needs to be transparent in front of the public and make an official announcement about the delisting stating the reason to the concerned. It is done for the general public and other market giants.

- Compliance: Further, the company needs to have original documents and compliance with all regulatory requirements from SEBI for the process to continue in a formal way.

- Final Delisting: After fulfilling all necessary procedures and requirements, the company’s shares are officially delisted from the stock exchange, and the trading procedure ceases for all traders and investors.

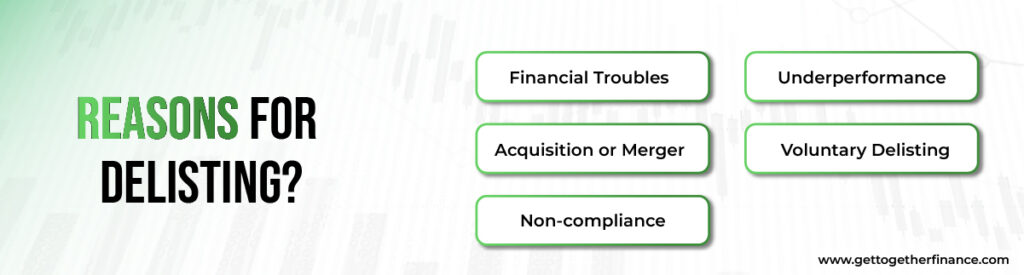

Reasons for Delisting?

Well, we have discussed the major reasons for share delisting above, now let’s understand them in a better way:

- Financial Troubles: If a company is consistently giving negative results and is facing consistent losses with a lot of debt, then it may decide to declare bankruptcy and decide to go with delisting.

- Non-compliance: There are certain rules of listing that every company needs to abide by, if the company fails to do so then the delist notice is sent by the stock exchange itself. This may include not submitting financial reports on time or not meeting minimum shareholder equity requirements.

- Acquisition or Merger: Mergers are acquisitions that happen when some other company buys the company and decides to merge with a competitor, in these circumstances, the company may decide to go private and, hence, decide to delist its shares.

- Voluntary Delisting: Sometimes, a company decides to voluntarily delist its shares from the exchange. This could be due to strategic reasons, like wanting more privacy, or if the costs of being publicly traded outweigh the benefits.

- Underperformance: If a company’s stock consistently underdelivers, investors may lose interest, leading to very low demand, hence now or negligible movement in shares, in this scenario company may decide to delist shares.

What Happens to Shares After Delisting?

After the delisting of shares, the trading of the particular shares ceases, which is no longer allowing traders or investors to sell or buy the shares. The investors can hold onto the existing shares.

Suppose the share delisting is a voluntary decision of the company. In that case, the company might offer to buy back the shares of the current shareholders at a decent price through a tender offer. However it is important to know that the price offered by the company may not be favorable for investors, they may have to let go of their holdings in the loss.

But in some cases where the deleting of shares is involuntary, that is not from the company’s side. It may be due to financial troubles or non-compliance with the stock exchange and SEBI regulations, the existing shareholders may find it difficult to sell the shares. They might need to seek out alternative trading platforms, such as over-the-counter markets, where the liquidity and transparency of trading are lower than on major exchanges.

Overall, delisting can have a major impact on existing owners, potentially lowering the value of their assets and making it difficult to sell their shares.

Also Read: Swap Market

Impact of Delisting on Investors

The voluntary delisting of shares is announced to all the investors through a formal letter via mail or any other means. Each shareholder also gets the form to sign up for the selling of shares if they want to. It’s totally up to the shareholders whether they want to sell their shares or not, the majority of them agree, and the delisting process continues.

If stockholders do not sell their shares to the company or the buyer within a certain time frame, they must sell them on a separate market known as the over-the-counter (OTC) market (DABBA TRADING). This can mean fewer opportunities to sell and lower pricing.

When a company imposes delisting voluntarily, it must buy shares from shareholders at a fair price determined by someone outside the company. However, after forced delisting, the value of shares typically falls. In addition, the company’s executives are barred from participating in the stock market for ten years following their forced delisting.

At Last

To summarize, share delisting is a big occurrence that can have serious consequences for both investors and the firms involved. Whether voluntarily or involuntary, delisting ends a company’s public trading on the stock exchange, limiting shareholders’ capacity to acquire and sell shares. Investors should carefully analyze the grounds for delisting and the potential impact on their investment portfolios. Before investing in any company, especially those with unstable finances or facing delisting issues, it is critical to conduct thorough research and due diligence. Making informed investment selections requires an understanding of the company’s financial health, regulatory compliance, and future prospects. Finally, investors should be cautious and prudent, understanding the possible dangers and rewards of investing in delisted or financially challenged companies.

FAQ’S

1. Why do companies choose to delist their shares voluntarily?

Companies may decide to delist their shares voluntarily due to low trading volumes, excessive compliance costs, or to pursue privatization. Share delisting can also happen during mergers, acquisitions, or restructurings.

2. What are the implications for existing shareholders when a company delists its shares?

Existing shareholders may see less liquidity and fewer chances to sell their shares. If the company’s prospects decline after it is delisted, shareholder value may suffer.

3. How does share delisting impact the liquidity and trading of shares?

Share delisting often affects liquidity because shares are no longer traded on public exchanges. Trading is limited to over-the-counter marketplaces, which may result in greater bid-ask spreads and fewer buyers and sellers.

4. What options do shareholders have if they decide to retain their shares after delisting?

Shareholders may continue to keep their shares after delivery, using other trading platforms or private transactions to buy or sell them. They may also consider tender offers, buybacks, or conversion to other securities issued by the corporation.

5. What are some common reasons for delisting shares from the stock exchange?

Financial difficulty, failure to meet listing criteria, regulatory challenges, privatization efforts, mergers and acquisitions, and strategic shifts are among the most common causes. Companies may also try to avoid public attention or lessen compliance burdens.

6. How can investors protect themselves from the risks associated with investing in companies facing delisting or financial troubles?

Investors should undertake extensive due diligence, monitor financial health and corporate governance, diversify their holdings, and stay up to date on company developments. Implementing stop-loss orders, setting investing limitations, and talking with financial consultants can all assist reduce risk.

Instagram

Instagram