Short Covering vs Long Unwinding: Meaning & Trader Tips

Table of Contents

ToggleOverview

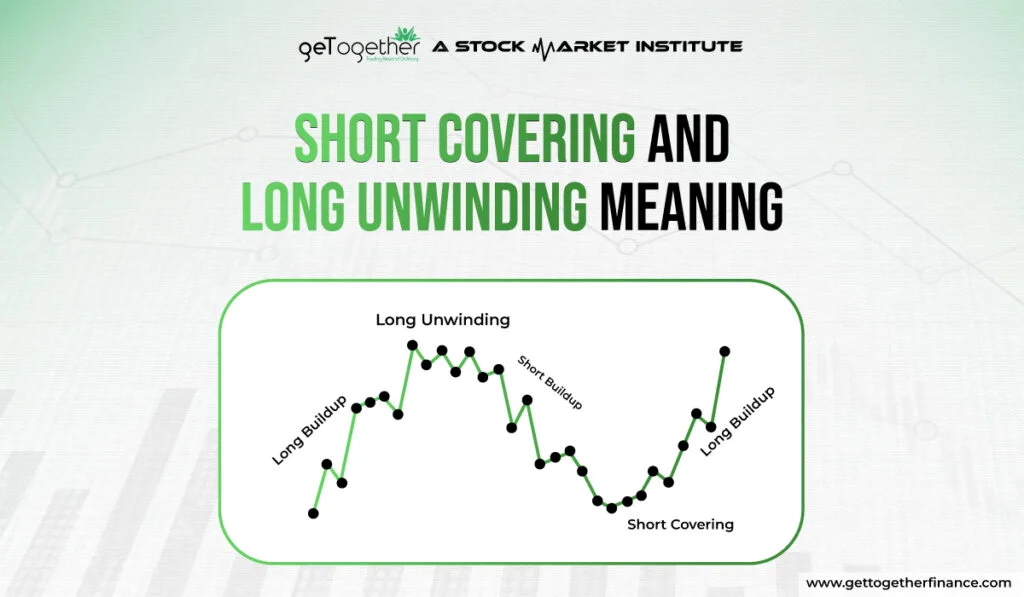

Short covering and long unwinding are recurring terms used in the life of traders and investors. Short covering happens when the trader first sells the share at a higher price and then anticipates the price to fall. Then the price falls at the trader’s determined level, and they buy the share at a lower price, booking the profit in between. This phenomenon allows the traders to buy back their shares hence increasing the buying in the market, which eventually shoots up the price.

Long unwinding, on the other hand, occurs when traders who have bought shares anticipating that the prices will go up, start booking their profits after the price reaches their target. This shift happens when traders start seeing that the peak of the price has been reached, and it’s a good time to sell their shares. At this time, selling increases, making the price fall down as supply exceeds the demand. Both short covering and long unwinding can influence stock prices in the short term.

In this blog, we’ll study how short-covering, long covering, long-unwinding and short unwinding occur in different aspects.

Long Buildup

Long buildup refers to the scenario where the traders and institutions are significantly buying the security. Here, they significantly buy the Call and Put options, increasing the volume of buying orders. Which, drives the price of security up (option price), giving it an uptrend since the demand has increased.

Likewise short buildups, long buildups are characterized by increased market activity and investor interest, which are frequently fueled by positive news, earnings releases, or other catalysts.

Long buildups are done to buy at low price and square off the position by selling the security at a higher price, making the money in between. When traders close the long position, it is termed as long unwinding.

Long Unwinding

In the simplest terms, long unwinding means squaring off the long positions that buyers have taken before the rally in price started. After the target of the trader is reached, they start booking profits.

The decision to sell the purchased shares can be stimulated by various reasons. For instance, investors and traders wait for the price to reach and square off positions from there anticipating that the price will go down here. Alternatively, the positions can be squared off if traders or investors need funds to put in other stocks or securities. Additionally, some market noise or sudden news in the market reading geopolitical effects, economic crisis, etc can induce panic hence shifting the market sentiments towards panic selling.

When a number of traders follow the long unwinding approach and start selling their shares, the supply of the particular stock increases hence making it fall. This is because the increase in supply (shares being sold) surpasses demand (buyers willing to purchase those shares), causing the price to fall continuously. Long-unwinding can thus have an impact on security and contribute to short-term fluctuations (mostly on the negative side) in stock prices.

Short Buildup

Short buildup refers to the scenario where the traders and institutions are significantly selling the security. Here, they significantly sell the Call and Put options, increasing the volume of selling orders. Which, drives the security’s price low since the supply has been significantly increased.

Short buildups are characterized by increased market activity and investor interest, which are frequently fueled by positive news, earnings releases, or other catalysts.

Short buildups are done to sell at a high price and square off the position by buying the security at a lower price, making the money in between. When traders close the short position, it is termed as short covering.

Also Read: Benefits of Holding Stocks for the Long Term

Short Covering

Short covering refers to the circumstances where the traders anticipate the price of the security is gonna go down after a good up move, and they start short selling after the peak.When a trader makes a decision to exit the short position after gaining profits as the prices of security have fallen, this process is called short-covering. It also happens, when the price doesn’t go down after the peak, instead it starts rising again, and traders buy back their sold position as soon as possible to cover their potential losses.

What’s the Difference Between Long Buildup, Short Buildup, and Unwinding?

Here’s a table with differentiation among all three:

| Pattern | Price Movements | OI Movements | What it Means | Simple Explanation |

| Short Buildup | Price decreases | OI increases | Fresh short positions | Long sellers are entering in the market |

| Long Buildup | Price increases | OI increases | Fresh long positions | Long buyers are entering in the market |

| Short Unwinding | Price increases | OI decreases | Short positions closing | Sellers exiting which cause bounce |

| Long Unwinding | Price decreases | OI decreases | Long position closing | Buyers exiting, trend weakening |

How Do You Identify Short Covering or Long Unwinding Using OI Data?

1.Short Covering

How to identify it

- Short covering in the stock market occurs when traders who sold earlier buy back their positions.

- Signal in OI and Price

- Price increases–OI decreases–short are exiting, short coverings.

Why This Happen

- Buying pressure pushes the price up.

- Short seller buys to the closing position.

- OI decreases because positions are being closed.

2. Long Unwinding

How to identify it

- Long Unwinding occurs when traders who bought earlier start selling.

- Signal in OI and Price

- Price decreases–OI decreases–longs are exiting, long unwinding.

Why This Happen

- Selling pressure pulls the price down.

- Long traders close their positions by selling.

- OI decreases because long positions are being closed.

Key Tips: Always check Price+OI together

How Do Short Covering and Long Unwinding Affect Market Trends?

- Short Covering and Market Trends

What Happens

- Short sellers buy back their position to exit.

- This buying pressure pushes the price rapidly.

Effect on Trends

- Triggers short-term rallies or bounces near the support level.

- Short covering in the share market can temporarily accelerate an uptrend.

- Indicate weakness in bearish momentum as short sellers exit their position.

- Long Unwinding and Market Trends

What Happens

- Long traders sell their position to exit.

- This selling pressure decreases the price.

Effect on Trends

- May signal trend exhaustion in an uptrend.

- May push the downtrend to move faster for a short period.

- Indicate weakness in bullish momentum as long traders are exiting.

- Combines Effect

| Scenario | Price Action | Trend Impact |

| Long Unwinding near resistance | Price decreases | Accelerates reversal |

| Short Covering near support | Price surges | Temporary uptrend |

| Short Covering in strong downtrend | Price rebounds | Minor bullish correction |

| Long Unwinding in uptrend | Price decreases | Trend reverses or slow |

Key Takeaways:

- Both reflect traders’ existing position, not taking bullish or bearish trades.

- They created short lived moves that can confuse traders unless interpreted with proper market context.

- Tracking OI with volume and price assists traders in marking these changes early and handling their position better.

How Traders Use Short Covering and Long Unwinding for Strategy Building?

Short Covering Strategy

Short Covering in the stock market occurs when traders who initially sold start buying back their positions, which generally creates upward momentum.

How traders use it:

- Breakout Confirmation: If a resistance breaks with high short covering, then traders view it as a long breakout and build long positions.

- Expiry Trades: Near weekly expiry, heavy short coverings on options indicate a strong move in market direction.

- Entry on Momentum Reversal: Short covering at the key support level suggests a likely bounce, encouraging traders to initiate long trades.

- Intraday Scalping: A sudden fall in Call OI + a surge in price is considered a short covering signal encouraging traders to capture upward moves.

Long Unwinding Strategy

Long unwinding in the stock market happens when traders close their buy position, which results in selling pressure.

How traders use it:

- Trend Reversal Identification: Consistent long unwinding signals trend exhaustion, prompting traders to anticipate a shift in direction.

- Exit Signal on Weakness: If long positions unwind and the price decreases, then traders cut their long trades early to protect themselves from bigger losses.

- Short-selling opportunities: When long unwinding rises, traders might open new short positions, expecting that the market will continue to move lower.

- Signal of Weakness: If the price decreases along with a drop in long OI, traders describe it as a long unwinding–a signal that the ongoing trend is weakening.

Pro Tip:

Focus on fresh OI addition:

Increasing price+ increasing OI= strong long buildup

Decreasing price+ increasing OI=strong short buildup

Common Misinterpretations in OI Analysis

The common misinterpretations in OI Analysis are:

- Assuming Rising OI Always Means Trend Strength: Most traders think that rising OI always confirms the trend, but:

- Increasing OI in an uptrend could be aggressive short or new longs.

- Increasing OI in uptrend could be panic longs and fresh shorts.

- Treating Long Unwinding as a Fresh Short Selling: When long OI decreases, it might simply mean existing buyers are closing their positions, instead of fresh sellers stepping in. In this, traders assume that the market is more bearish than it actually is.

- Misjudging Expiry Week Movements: During expiry week:

- OI fluctuates because traders are realigning positions and managing their risk.

- Quick unwinding happens

- Believing Writers are Always Right: Option writers are usually experienced, but:

- They also get trapped during sharp moves.

- Sudden reversal can force them to cover quickly.

- Confusing Short Covering with Long Build-Up: When the call OI decreases while the price increases, it indicates that short sellers are closing their position. But some traders mistake it as a new long position, which results in wrong entries.

- Reading OI in Isolation: OI + Price have to be together. OI alone cannot tell:

- Who is exiting

- Who is entering

- Whether the move is weak or strong

- OI patterns change during:

- News releases

- High volatility

- Events

If context is not taken into account, then OI readings become misleading.

- Assuming High OI means Strong Resistance/Support: High OI at strike show interest, but:

- It can move fast

- Traders might be taking positions just to manage risk, not because they expect the market to move down/up.

- Resistance/Support is valid only if the price reacts to it.

Conclusion

Short covering and long unwinding are two critical phenomena in the worlds of trading and investing, with different ramifications for market dynamics. Short covering is the process of closing short positions by buying back shares, which is often prompted by a rising stock price, resulting in greater buying pressure and potential price spikes. Long-unwinding, on the other hand, comprises selling previously purchased shares to lock in profits, which is frequently motivated by hitting target prices or shifting market sentiment, resulting in short-term price drops as supply exceeds demand. Both behaviors demonstrate the delicate interplay between investor behavior and market conditions, which influences stock values in the short term. Understanding these dynamics is vital for traders and investors to navigate the complexities of financial markets, allowing them to efficiently change their methods to capitalize on opportunities and mitigate risks.

FAQs

How Does Short Covering Happen?

Short covering occurs when short sellers anticipate possible losses if the stock price unexpectedly rises. To limit their losses, they repurchase shares they had previously sold short. This action raises demand, resulting in higher price movements known as a short squeeze.

What happens to stock prices in long unwinding?

Long unwinding entails selling previously acquired shares to lock in profits. As more investors unwind their long positions, the stock’s supply grows faster than demand, triggering short-term price declines.

How does long unwinding occur?

Long unwinding can occur when investors meet their profit expectations or believe the stock has peaked. Furthermore, changes in market sentiment or the necessity for funds for other investments can cause investors to exit their long positions.

Why do short sellers cover their positions?

Short sellers close their holdings to limit potential losses if the stock price increases against their predictions. They want to liquidate their bets and limit further losses in a rising market by repurchasing the shares they sold short.

What causes short covering to increase buying pressure?

Short covering enhances purchasing pressure as short sellers hurry to repurchase shares that they had previously sold. This increasing demand may result in a u0022short squeeze,u0022 in which rising prices motivate additional short covering, driving upward momentum in the stock price.

How long does the effect of long-unwinding remain on the market?

Long-unwinding can harm market sentiment since it indicates investors’ profit-booking behavior and implies a lack of trust in future price increases. This shift in sentiment may contribute to short-term price reductions as selling pressure rises.

What induces traders to engage in long unwinding?

Traders may participate in long-unwinding to capitalize on profit chances after a stock’s price has reached its desired levels. Furthermore, the necessity to diversify investments or adapt to changing market conditions may cause traders to unwind their long positions.

What distinguishes short covering from long unwinding?

Short covering is the practice of purchasing back shares that have previously been sold short in order to prevent losses, which are usually caused by rising stock prices. Long unwinding, on the other hand, comprises selling previously purchased shares in order to lock in profits, which is frequently motivated by meeting profit targets or shifting market sentiments.

Instagram

Instagram