Solvency Ratio

Table of Contents

ToggleIntroduction

To analyze a person’s finances, we check how they have purchased things, how much money they have to pay, and how much earnings they have. The same goes for a company. The solvency ratio is the criteria that helps in checking whether the finances of the company are in a good position or not. The solvency ratio is one of the many criteria that help in predicting whether the company can survive long in the market or not.

A company runs on a certain capital and this capital comes from various sources. Some are in the form of investment and some are in the form of loans or debts. A company has two types of funds, debt and equity. Equity is the invested money and in return, the investor gets a share in the company.

Whereas, the debt is similar to the loan. The company has to clear off debts with interest. The company needs to repay its debtors. Every company has a different ability to repay its debts, and this ability to repay or clear its debts is known as the solvency ratio.

To work in a profitable way, a company should have adequate cash flow along with investments to clear its short-term as well as long-term debts.

What is the Solvency Ratio?

A company’s ability to clear its long debts with the help of current assets is measured by the solvency ratio. Since it helps in determining whether the company can pay off its debts freely or not, it is a determinant of the financial health of the company.

Instead of measuring the net income of the company, this ratio undertakes the actual cash flow of the company. This helps in giving a realistic answer to the board of directors. Depreciated assets and non-cash expenses are also considered in the solvency ratio. This helps in determining the company’s position to stay working more closely.

Many investors consider looking into this ratio of the company before investing in it. It helps them know whether the company has enough assets or resources to settle their debts at some point and work freely. Further, investors can have a clear idea about the functioning and capacity of the company in terms of finances.

Since this ratio considers various aspects of the business apart from just the net income. It significantly helps in determining whether the company can stay profitable in the long-term view.

Understanding Solvency Ratios

In the simplest terms, solvency ratios are financial tools or metrics that are used to judge the company’s capability to settle its long-term debts. It is an indicator of the company’s financial health. Many institutional investors have a look at a company’s solvency ratios to determine the reliability of the company in terms of monetary benefits before investing in it.

To summarize, a higher solvency ratio indicates a strong grip of the company over its financials. Indicating that the company has a good history of paying off its debts and has liquid assets to keep up in disastrous situations. Whereas, the complete opposite is believed when the solvency ratio is low. That clearly shows that the company is struggling to pay off its regular debts.

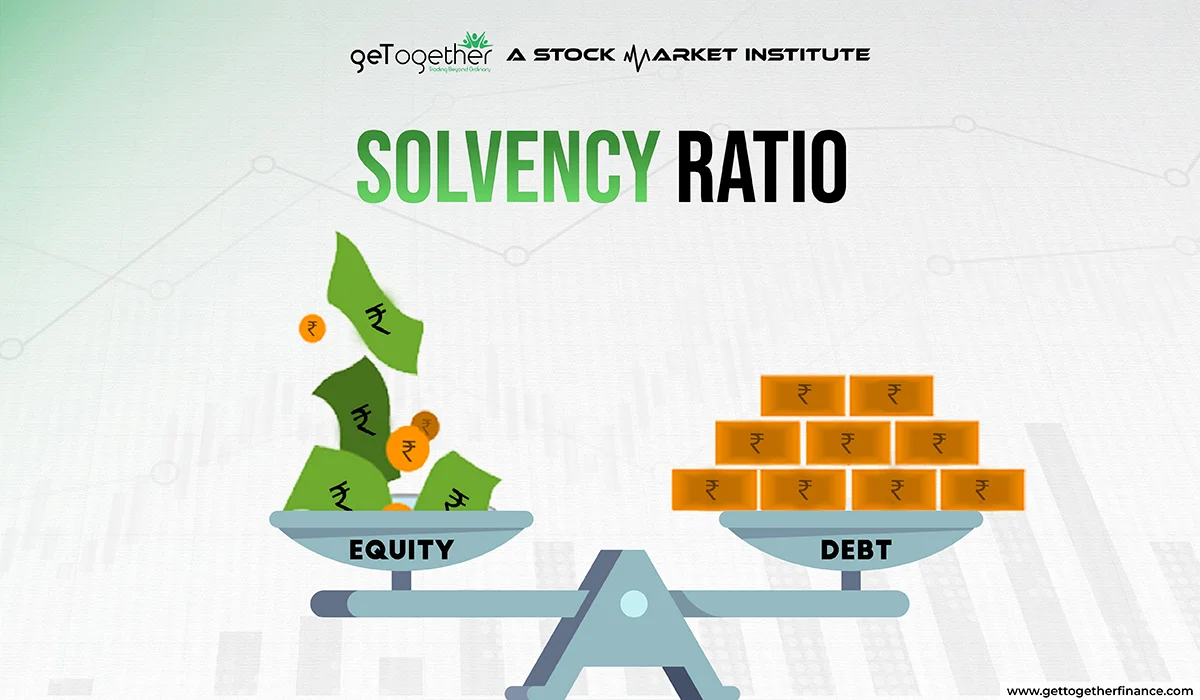

How to Calculate the Solvency Ratio

The solvency ratio is calculated by adding the company’s net income after tax and noncash expenses like depreciation and dividing this sum by total liabilities. This ratio represents the proportion of assets financed by the company in debt vs equity. A greater solvency ratio indicates that a company is financially strong and relies less on debt to fund its operations, whereas a lower ratio may indicate financial instability and difficulties in satisfying debt obligations. A solvency ratio of 20% or above is generally regarded as good and reliable, however optimal values vary by industry and should be compared to other benchmarks before investing.

Types of Solvency Ratio

There are four different types of solvency ratios:

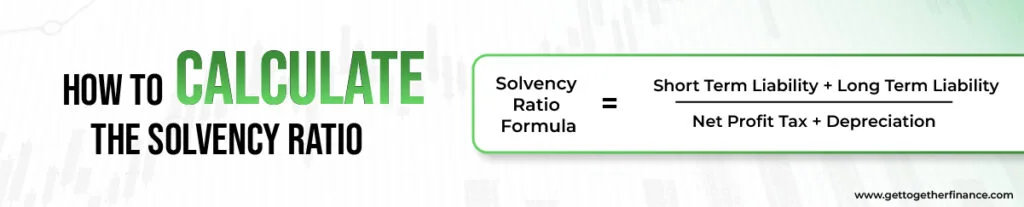

1. Debt-to-Asset Ratio:

This ratio simply tells how much the company is in debt compared to its current assets. If the company has a higher debt-to-assets ratio (above 1.0), it indicates that the company is short of funds and the amount of debt is overtaking its assets and profits. Whereas, if the company has a lower ratio (below 0.9), it indicates that the company is in a profitable situation.

2. Interest Coverage Ratio:

This ratio helps in determining how many times a company can pay the current interest rates in their existing funds or current earnings. In simpler terms, it helps in determining how much a company can work in terms of financial crisis or any sudden risk.

If this ratio is high, then the company is said to be in a good financial position and is capable of handling financial crises. Whereas if the ratio is lower (below 1.5), then the financial situation of the company is not good. In this case, the company will not be able to pay the interest to the debtors regularly with the existing funds.

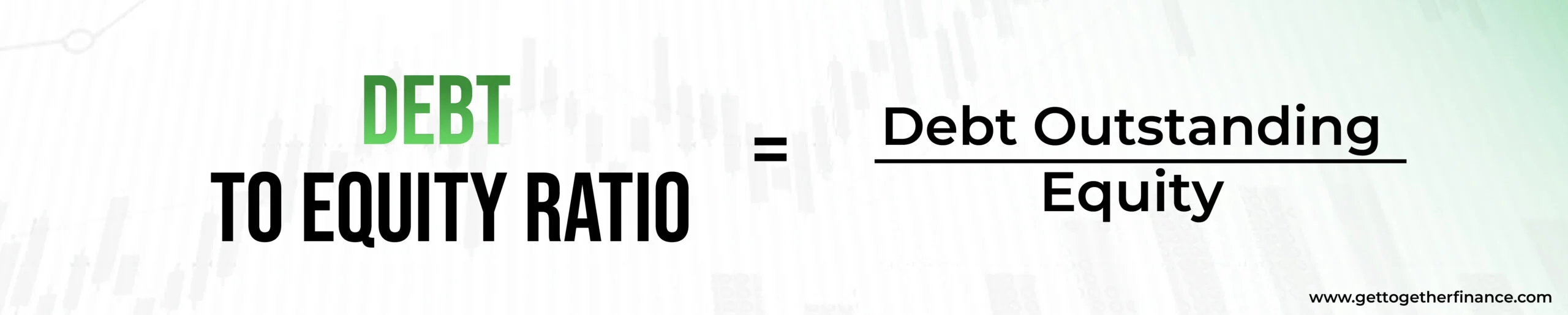

3. Debt-to-Equity Ratio:

The debt to Equity ratio helps in comparing how much the company has borrowed and how much money the investors or owners have put into it. If the debt-to-equity ratio is high, then the company will be in trouble to pay off their debts. Whereas, the lower the ratio, the more profitable the company is. In case the company liquidates, the company with a lower Debt-to-equity ratio will not face any problems. This is because they have enough money or capital to clear their debts.

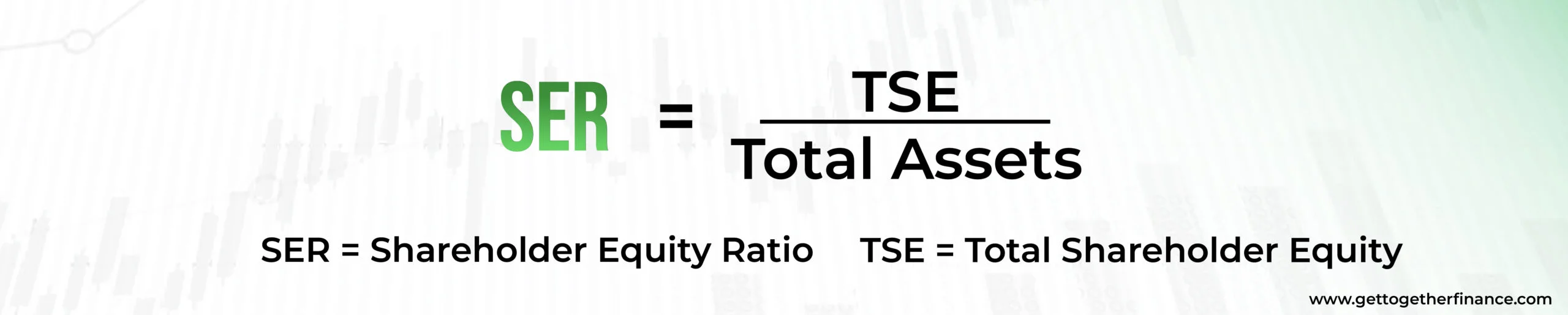

4. Share Holder-Equity Ratio ( SER ):

It is also known as the shareholder-equity ratio. This ratio helps in knowing how much of the company’s capital is funded by equity compared to the total capital.

Here, if the ratio is higher, the company is in a good financial position. Whereas, if the ratio is lower, the company has less equity compared to debt, which signifies a critical financial position.

Also Read: Return on Capital Employed

Importance of Solvency Ratio

- This ratio helps in determining how the different business operations are affecting the cash flow of the business. Since every aspect of money is considered in these ratios, it helps in identifying how the company is going to perform in the long term based on current finances and operations.

- With the help of clear data about the solvency ratios, the board of directors can set up an adequate budget for the company. Adequate allocation of funds in different areas of business can be done to generate higher revenue. This is because the ratio provides data about the financial priorities of the company.

- Financial risk can be easily assessed with all the afore mentioned ratios. It helps investors in knowing whether to invest in a company or not.

Limitations of Solvency Ratio

It must be clear by now that solvency ratios consider the amount of debt the company has to assess its financial position. However, if we decide to compare two companies of different sectors, solvency ratios might not be the perfect criterion.

A company can have a low debt amount but mismanaged financial practices. Low debt can lead to a good solvency ratio, but this doesn’t mean good financial condition. When the company is not utilizing its finances well and has distorted cash management, then its adequate solvency ratio and low debt are of no good.

Different companies need varied capital based on their nature of business. A manufacturing company will always have a higher debt compared to the service provider company. This is because manufacturing companies need more resources and types of machinery to function. But, in this case, higher debt doesn’t justify a bad financial position. Hence, the solvency ratio shouldn’t be the only criteria to look at to assess the company’s financial position. Also, the manufacturing company might have higher debt, but adequate financial management. Having an adequate financial management process can surely boost their profits.

What is the Difference Between Solvency Ratio and Liquidity Ratio

Though both ratios are used as metrics for a company’s financial health, both have different aspects of it.

Solvency ratios determine the ability of the company to settle its long-term debts. Whereas, liquidity ratio helps in knowing a company’s ability to wave off its short-term liabilities by converting its assets into immediate cash.

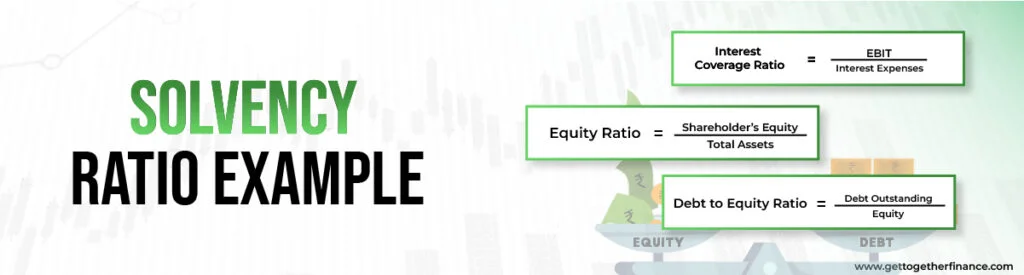

Solvency Ratio Example

Here are the examples of different solvency ratios that we studied above:

1. Debt to Equity Ratio

For example, XYZ company has a total debt of $1,000,000 and equity sharing of $2,000,000. Using the formula we study above,

Debt-to-Equity Ratio= 2,000,000/1,000,000 =0.5

In this case, XYZ company’s Debt-to-Equity ratio is 0.5. This means that for every dollar of equity, the company has 50 cents of debt. A lower ratio indicates a very low financial risk, as it shows that the company is using less debt to finance its working operations, whereas a higher ratio indicates higher financial risk as it shows a greater use of debt money for regular company operations.

2. Interest Coverage Ratio Example

For example, company XYZ Inc. reported an operating income of $500,000 and interest expenses of $100,000.

Using the formula we studied:

Interest Coverage Ratio= 100,000/500,000 = 5

Here, XYZ Inc. has an Interest Coverage Ratio of 5. It implies that the company’s current operating income is sufficient to cover its operating expense along with debt interest for five times over. A higher ratio means that the company is able to pay off its interest regularly, lowering financial risk. Conversely, a lower ratio suggests that the company may have difficulty meeting its interest payments, indicating higher financial risk.

3. Equity Ratio Example:

For example, ABC Corporation has shareholders’ equity of $2,000,000 and total assets of $5,000,000.

Using the formula we studied:

Equity Ratio= 5,000,000/2,000,000 =0.4

Here, ABC Corporation has an equity ratio of 0.4, or we can say 40%. This means that 40% of its total assets are from or financed by shareholders’ money while the remaining 60% is by debt or other liabilities.

A higher equity ratio indicates a lower financial risk because it means that the company has a larger proportion of its assets financed by equity rather than debt. Conversely, a lower equity ratio may indicate higher financial risk as it suggests a higher reliance on debt financing.

Conclusion

In conclusion, solvency ratios provide an important insight into a company’s financial health and ability to satisfy long-term obligations. These ratios provide crucial insights about a company’s risk of default and overall stability by examining the balance between debt and equity. Debt-to-equity and debt-to-assets ratios are important tools for investors and stakeholders to use when making informed decisions about a company’s financial status, assisting in sensible investment decisions and limiting potential risks.

FAQ

What is a solvency ratio?

A solvency ratio evaluates a company’s capacity to meet long-term financial obligations. It measures the proportion of assets financed by debt versus equity, as well as long-term financial stability.

How is the solvency ratio calculated?

The solvency ratio is calculated by dividing a company’s net income + depreciation by its long-term debt and other liabilities.

Why is solvency ratio important for businesses?

Solvency ratios reveal a company’s long-term financial health and ability to maintain operations, pay debts, and grow. They are critical for determining financial viability and attracting investors.

What does a high solvency ratio indicate?

A high solvency ratio suggests a solid financial situation with enough assets to meet long-term obligations. It implies less financial risk and greater investor confidence.

What does a low solvency ratio suggest?

A low solvency ratio indicates increased financial risk, implying that the corporation may struggle to satisfy long-term obligations. It may dissuade investors and lenders, potentially resulting in liquidity troubles or insolvency.

How does solvency ratio differ from liquidity ratio?

Solvency ratios measure a company’s ability to meet long-term obligations, whereas liquidity ratios analyse its ability to satisfy short-term obligations. Solvency ratios evaluate overall financial health, whereas liquidity ratios assess short-term liquidity.

What are typical benchmarks for solvency ratios?

Solvency ratio criteria vary by industry, however they should be higher than 20% to 30%. However, the appropriate ratio is determined by factors such as industry standards, firm size, and business style.

How frequently should solvency ratios be analyzed?

Solvency ratios should be reviewed on a regular basis, usually quarterly or annually, to track changes in financial health and assess long-term viability. However, frequency may vary depending on business needs and industry standards.

What factors can impact a company’s solvency ratio?

Revenue, expenses, asset valuations, debt levels, interest rates, economic conditions, and industry competition all have an impact on solvency ratios. Capital structure and investment strategies are examples of management actions that have an impact on solvency ratios.

How does a company improve its solvency ratio?

A company can its its solvency ratios by growing profitability, lowering debt levels, enhancing asset utilization, attracting equity investments, and maintaining a healthy balance of debt and equity financing. Implementing efficient financial management procedures is critical to improving solvency ratios.

Now that we have read about Solvency Ratio, Let’s read about one more important term which is essential for any company to operate and that is :- WORKING CAPITAL

CATEGORIES

Facebook

Facebook Instagram

Instagram Youtube

Youtube