Stock Chart Patterns: How to Spot?

- December 21, 2024

- 894 Views

- by Manaswi Agarwal

As an enthusiast of the stock market, chart patterns help traders to predict future price movements in an asset. How to spot a stock’s chart pattern, how to trade the chart patterns are the most prominent questions asked by traders. This comprehensive guide will guide you how to spot the stock chart patterns.

Table of Contents

ToggleFlag Pattern

To spot a flag pattern among the various stock chart patterns, you need to identify that the candlesticks represent equilibrium between the bears and bulls in the market. When a flag pattern forms, there are no significant highs and lows. The two parallel trend lines that can slope up, down or sideways indicate the formation of a flag pattern. Let us understand how to spot a bull flag?

Traders can spot the bull flag when there is an upward movement in the security forming a pole of the flag and consolidation takes place between the two parallel trend lines, when a breakout is given above the upper trend line, it represents a bullish flag.

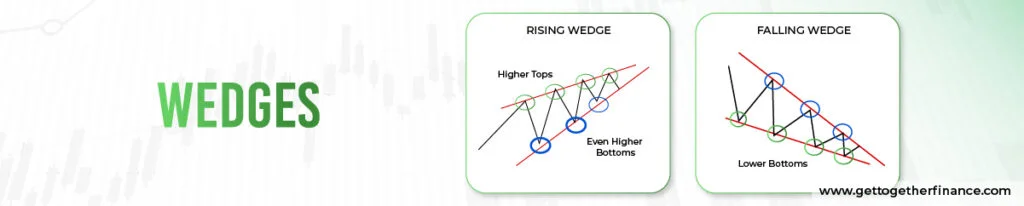

Wedges

Wedge pattern is formed by two converging trend lines. Both the trend lines move in the same direction either they move up or down. The wedge pattern usually takes a formation in uptrend as the trend lines are formed with higher highs and higher lows. Let us identify how a rising wedge forms in the chart pattern.

The rising wedge pattern usually forms when the price continuously makes higher highs and higher lows which is formed in an uptrend and signifies a reversal to the downside with the continuation of the bearish movement.

Ascending and Descending Triangle Chart Pattern

To identify an ascending triangle stock chart pattern, traders tend to spot a series of higher lows where buyers become aggressive. The flat resistance level shows that the price continuously hits the same point and does not break it while forming a new high. An existing upward trend or a rising trend with a support level indicates a buying pressure helping the traders to spot the ascending triangle pattern. Now the question is, how to find a descending triangle chart pattern?

On the other hand to identify a descending triangle chart pattern, traders spot a series of lower highs depicting that sellers are becoming dominant. The price hits the flat support line each time but does not break the same.

Also Read: Descending Chart Pattern

Double Top and Bottom

To spot the double top stock chart pattern on the candlestick charts, a trader usually looks for two peaks in the prices after which the price retraces in an uptrend. The two peaks signify the double top chart pattern with the neckline that connects the lowest point of the two peaks. This is identified as the bearish reversal pattern as it implies that even after the two attempts, the price was not able to break the certain and hence it continues to go downwards.

Similarly, when double bottom is formed, traders spot the bullish pattern as it implies that even after the two attempts, the price could not break the resistance level by falling further and hence it is expected to move upwards indicating a bullish signal.

Head and Shoulder Pattern

Traders spot the head and shoulder stock chart pattern when the chart forms three peaks, the middle one being at the higher levels when compared to the other two peaks. The head and shoulder includes important components like left and right shoulder, head and neckline. The neckline is the support level that confirms the formation of this pattern. A trader spots the uptrend, left shoulder, head (highest peak), right shoulder and the neckline.

The formation of this pattern ensures a bearish move in the security which implies that sellers are active in the market. Therefore, the pattern indicates a move from being bullish to bearish one.

All of the above patterns are easy to find on the charts. These chart patterns are widely used in the stock market by traders. The wide and excessive usage of these chart patterns has made these techniques obsolete. To overcome this, demand and supply chart pattern is found to be an appropriate method to work in today’s era. In this new world of stock market, new techniques must be implemented to obtain great returns from the market and achieve success.

How to spot Demand and Supply in the Stock Market?

Demand and supply is the basic concept on which the stock market tends to work. To identify the price action, demand and supply zones indicator the buying or selling pressure in the security.

Spot Demand Zones

Drop Base Rally: A Drop Base Rally (DBR) is a strong demand zone, where the price takes a drop in the first candle (legin), followed by the base candle and a rally (legout candle). The base candle signifies the fight between the buyers and sellers. The formation of a legout candle after the base implies strong buying pressure in the security.

Rally Base Rally: The demand zone of a Rally Base Rally (RBR) represents a continuous buying pressure in the security. The first rally or legin candle indicates the beginning of bullish movement and second rally after the base represents buyers as the winners of the fight previously.

Spot Supply Zones

Rally Base Drop: Rally base drop signifies a supply zone where the selling pressure begins in a security. The zone is identified when the price takes a drop after the fight between sellers and buyers. Traders spot a strong supply zone when the prices take a significant drop after experiencing a continuous rise followed by a fight representing sellers as the winners of the move.

Drop Base Drop: In this kind of supply zone, the price takes a significant drop after the formation of a red legin and a base candle. When the price is expected to hit this zone the next time, it is expected that sellers would become active and the price would take a nosedive.

The Bottom Line

In trading and investment, stock chart patterns help to predict the future action of prices. There are some common stock chart patterns that are widely used by traders to execute their trades on a breakout level. However, demand and supply zones on the charts are the most reliable pattern that depicts the buying and selling pressure in the security.

FAQs

What are the chart patterns?

The stock chart patterns identify the buying or selling pressure in the security. There are some chart patterns that provide a signal about bullish or bearish movement in the prices of the assets.

Which are the best stock chart patterns?

Some of the commonly traded stock chart patterns are flag pattern, double top and bottom chart pattern, wedges, head and shoulder pattern, ascending and descending triangle pattern. Demand and supply zone pattern is the most reliable pattern for trading and investment.

How to spot Flag Chart Patterns?

To spot flag chart patterns, traders draw two parallel lines that indicate the formation of a flag pattern and hence predict future price movements.

Instagram

Instagram