Understanding Support and Resistance Basics

Table of Contents

ToggleIntroduction

With the Indian economy being called the “Bright Spot” in the world by the IMF President, the focus on the Indian stock markets is growing. So is the number of investors and traders who aim to build a fortune by investing in India.

Today, it is important for you as a trader to understand the basics of how the stock markets function and be updated about the developments around the world. One such concept is support and resistance.

The market price of a stock is determined by the forces of demand and supply. Buyers and sellers create their orders at different prices, which are called Bid and Ask prices, respectively.

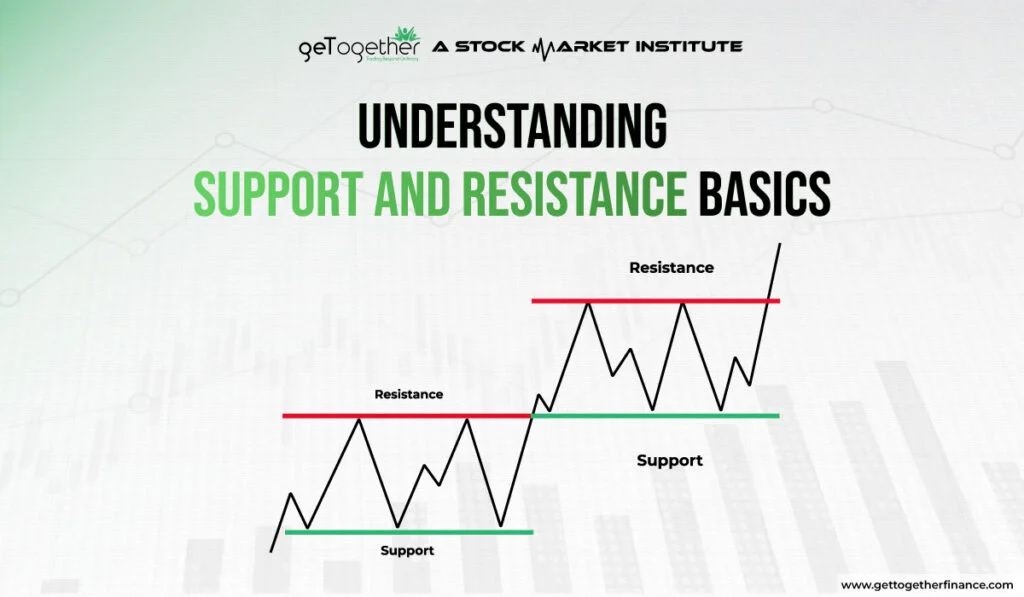

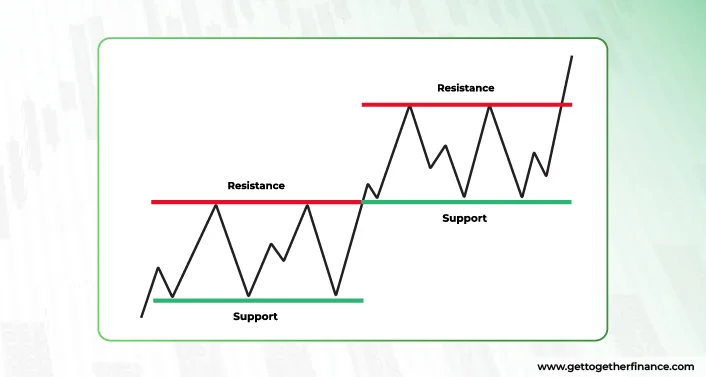

At some price levels, buyers and sellers form clusters due to multiple and high-volume orders (demand or supply concentration). These are called support and resistance levels. Simply put, they provide a range between which the market price of a stock usually moves.

This blog details the concept of support and resistance trading for your understanding.

What Is Support?

When the stock market is in a downtrend, i.e., the market price of a stock is falling, the price level at which the downtrend is expected to stop is called a Support Level. This is due to the phenomenon of demand concentration.

As the stock price falls toward the support levels, buyers place more orders anticipating a price rise, which creates a floor that prevents the prices from falling further.

A trader looking for support and resistance for trading sees the support levels as the prices where demand will surge. As a result, more people buy at these levels to earn profits, and the price rises.

How To Determine A Support Level?

Multiple factors need to be analyzed carefully before determining a support level. If you pick the wrong clue, it can cause your capital to erode. Here’s how you can determine the support levels:

- Historical Price Points: Looking back is always an important step. By studying the stock’s historical price, you can recognize patterns and levels from which the price rebounded.

- Draw Trendlines: When the market is downtrend, you can draw a line by connecting the lows created by the stock price. This is called the trendline. It shows the various levels at which the stock price can rebound.

- Moving Averages: Usually, the 50 or 200-day Moving Averages are used as a benchmark to determine the support levels. In an uptrend, if the price line cuts the MA line from below, the price goes further up. Hence, it acts as a support level.

- Volume Analysis: When the price is close to the potential support levels, and the volumes rise, it generally shows a surge in demand. Hence, the price might rise from these levels.

What Is Resistance?

When the stock market is in an uptrend, i.e., the market price of a stock is rising, the price level at which the uptrend is expected to stop is called a Resistance Level. This is caused due to the phenomenon of supply concentration.

As the price of a stock reaches the resistance levels, the sellers place more orders anticipating a fall in the price, leading to the creation of a ceiling. This prevents the prices from rising further.

A trader looking to trade the resistance sees these levels as the prices where supply will surge. As a result, more people sell at these levels to book profits, and the price falls.

How To Determine A Resistance Level?

Similar to determining the support levels, multiple factors need to be analyzed carefully before putting your hand in resistance trading. Here’s how you can determine the resistance levels:

- Historical Price Points: By studying the stock’s historical highs, you can recognize patterns and levels from which the price has retraced.

- Draw Trendlines: When the market is in a downtrend, you can draw a line by connecting the highs created by the stock price. This trendline shows the various levels from where the stock price can retrace.

- Moving Averages: Usually, the 50 or 200-day Moving Averages are used as a benchmark to determine the resistance levels. In a downtrend, if the price line cuts the MA line from above, the price drops further. Hence, it acts as a level for resistance trading.

- Volume Analysis: When the price is close to the potential resistance levels, and the volumes rise, it generally shows a surge in supply. Hence, the price might fall from these levels.

Also Read: Demand and Supply

How to Trade Support & Resistance?

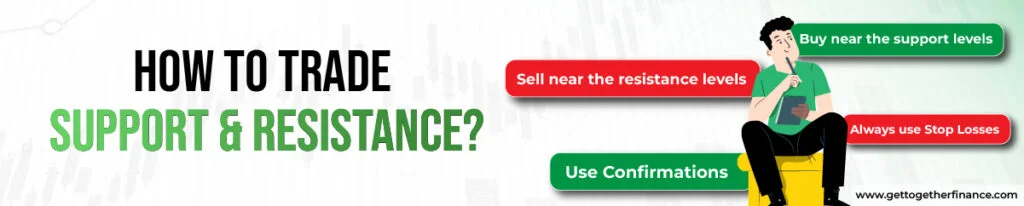

Now that you have understood the support and resistance basics, you need to learn how to trade when the price is near the support or resistance levels.

If you jump to trade without a proper strategy, it can harm your capital. Here’s how you can use the support and resistance strategy to maximize your profits:

- Use Confirmations: Price movements in the stock markets are unpredictable. Hence, it is important to cross-check your analysis. If the following signals accompany the support and resistance levels, you should consider it as confirmation:

- Formation of Candlestick patterns

- Spikes in the Volume

- Moving Averages

- Momentum Indicators

- Market Factors

- Buy near the support levels: As the stock price approaches the support levels, you can buy the shares and wait for the rise in prices to book profits.

- Sell near the resistance levels: As prices approach resistance levels, sell shares and book profits. Wait for prices to fall before buying again.

- Always use Stop Losses: You can place stop losses above the resistance and below the support at ideal levels to avoid losses due to wrong judgment.

If you want to ace the game of trading support and resistance, enroll in the GTF Trading in the Zone and Options Trading Course. We provide in-depth coverage of all relevant concepts about stock trading so that you are well-equipped to start your journey immediately.

Breakout of Support or Resistance

Stock markets are based on probability, and we cannot be 100% certain about our analysis unless the market moves in that direction. So, there are instances where the support and resistance trading can go wrong.

- Breakout below the Support: In a downward trending market, if the selling pressure is so high that the price moves considerably below the support levels, we call it a breakout below the support. In this case, the support becomes the new resistance for the share price.

- Breakout above the Resistance: In an upward-trending market, if the buying pressure is so high that the price moves considerably above the resistance levels, we call it a breakout above the resistance. In this case, the resistance becomes the new support for the share price.

How can we avoid heavy losses caused in such a scenario? Well, you can do 2 things:

- You can wait for confirmation through sustained price movements to check whether the support and resistance are strong before placing the order.

- Place the stop loss orders carefully to avoid any shocks.

Dynamic Support and Resistance

Until now, our discussion has used support and resistance as static concepts defined by horizontal lines. However, the stock markets are ever-evolving, and it is not logical to believe that prices will always move between static levels. Hence, the concept of Dynamic Support or Resistance.

Dynamic levels of support and resistance study the trend momentum of the price to predict future price movements. You can use the following tools along with the price action to derive these trends:

- Simple Moving Averages

- Exponential Moving Averages

- Stochastics

- Bollinger Bands

- Ichimoku Cloud

Join our Trading in the Zone and Options trading course to learn about these concepts in detail.

Conclusion

We have reached the end of this blog. We have discussed the basics of stock trading using support and resistance. GTF provides the most affordable stock market course online to help you kickstart your trading journey. Visit our website to explore more!

FAQs

What are the fundamentals of support and resistance?

Support and resistance show the price levels at which the stock price changes direction. If the price is near the support levels, the prices can move upwards, and vice-versa if the price is near the resistance levels.

What is the rule of support and resistance?

The levels at which the price of a stock changes direction are called support and resistance. While the support creates a floor and prevents the price from falling, the resistance acts like a ceiling to prevent the price from going upwards.

What is the concept behind support and resistance?

Support and resistance are purely dependent on the demand and supply of shares. At the lower price levels, i.e., the support price, buyers overpower the sellers, and price rises. Whereas the sellers exceed the buyers at resistance levels, the price falls.

How do we learn support and resistance?

Learning support and resistance trading can be a tedious task if you do not get proper training. Right from learning the basics of analyzing the price movements to practicing on live simulators, there are many steps you should follow. Join the GTF Trading in the Zone and Options Trading Course to start learning Now!

Facebook

Facebook Instagram

Instagram Youtube

Youtube