Tick Size: Definition in Trading, Requirements, and Examples

Introduction

Tick size or Tick Price refers to the minimum price movement of the security or the stock. It represents the smallest movement by which the price of the security can fluctuate or change. The knowledge about tick size and its regulations is important for traders because it directly impacts their capital positioning and risk management strategies. The smaller tick size allows traders to catch more precise prices of the stock; facilitating smoother transactions and tighter bid-ask spreads. On the contrary, larger tick-price markets with lower trading volume. By knowing the importance of tick size, traders can have an effective hold on the market and capitalize on opportunities as well as mitigate risks associated with price fluctuations.

What is Tick Size in the Stock Market

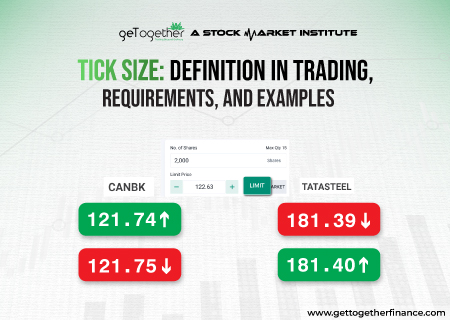

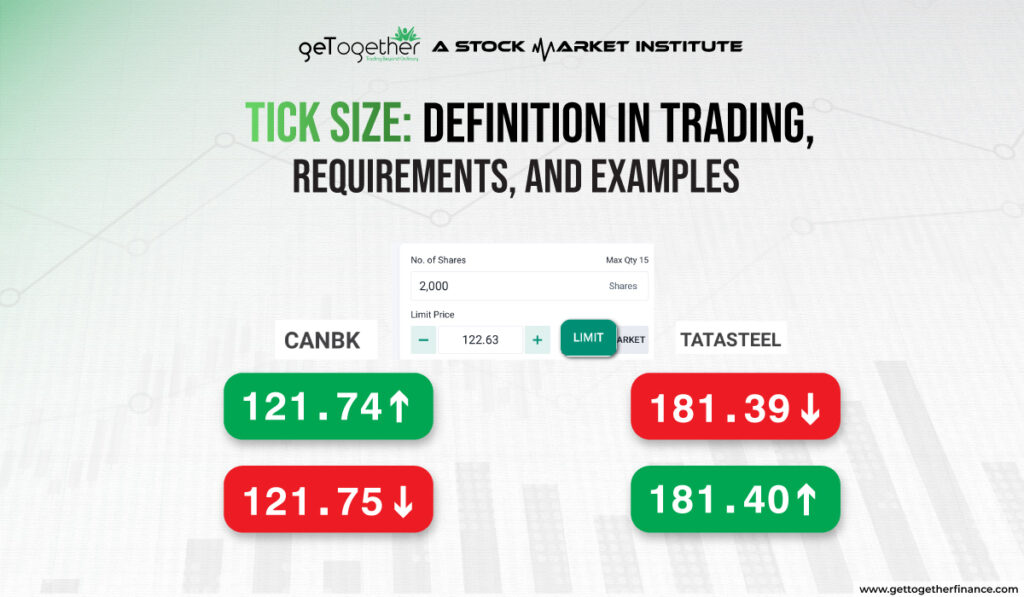

Tick size in the stock market represents the price movement by which the stock can fluctuate its prices. Let’s understand this by a simple example, if the tick price of a stock is ₹0.01, its price can change from ₹10 to ₹10.01, 10.02.. And so on. This way, tick prices are an important metric to know prices are changed and quoted in the live market. The limit order values are highly affected by the tick price of the stocks.

How are Tick Size and Stock Prices Related?

Stock prices and tick size relationship is something that is important for traders to understand. A smaller tick size in the stock market allows the stocks to move in minute price movements, providing a finer overview of uptrend and downtrend; it enables more precise pricing and tighter bid-ask spreads for traders. This precision in the stock or security prices helps traders in catching more finer movements and place orders on favorable price levels, eventually reducing transaction costs.

You might be wondering how transaction cost is affected by tick price, let’s understand this. For instance, if a trader wants to buy a stock or security, the smaller tick size will allow them to place an order nearest to the last traded price (LTP). This reduces the bridge between bid-ask spread. On the contrary, a larger tick price can increase the bridge between bid-ask spreads, making trades more expensive overall (mainly for bulk orders).

Tick Size in Different Markets

Tick size is pre-determined for different types of security by SEBI and respective exchanges. It varies for stocks, FnO contracts, Commodities, and Forex markets. In the stock market, the higher-priced stocks generally have higher ticket prices, and their prices change at a greater margin. Whereas, the stock that is priced at the lower level has a low tick price, giving more precise movement.

In future contracts, tick sizes can vary differently among securities. For example, the tick price for crude oil futures is ₹1 per barrel, meaning every one rupee change will result in a profit/loss of 10 rs. Further, for the G-Sec future, the tick price is ₹0.0025.

In the forex market, the tick price are completely different due to extremely high liquidity. The nature of trading and liquidity makes the tick size very small, to ease the trading process. Tick sizes in options markets vary depending on the underlying asset, strike price, and expiration date.

Recent Changes in Tick Size

A recent announcement by NSE conveyed that as of 10th June 2024, the tick size for stock trading below ₹250 will be tick size ₹0.01. Earlier, it used to be 0.05. This decision was taken to bring more precision for traders and enhance the liquidity of the Indian stock market.

Earlier, BSE made a similar move in March 2023; it reduced the tick size to ₹0.01 (1 paisa), to enhance the liquidity.

Institutional and experienced brokers believe the reduced tick price and precision in stock prices give traders to experiment with the trading strategies.

Factors Influencing Tick Size

Here are the core factors that are responsible for influencing tick size:

- Market Volatility: Market volatility refers to the speed with which the price of securities fluctuates. In a highly volatile market, the prices can change by a greater amount in a span of milliseconds. Smaller tick price can help in capturing these movements well. If the tick price is high, getting the stocks at favorable prices in a volatile market gets tough.

- Liquidity: It refers to how many shares can be bought or sold without affecting the trading price of the stock. Highly liquid markets, where the buying and selling of orders is hassle-free are supported by lower tick prices. This allows more tighter bid-ask spreads. In less liquid markets, bigger tick price may be needed to keep order and stability.

- Securities Class: Different securities such as stocks, bonds, futures, currencies, options, and commodities have different trading charges, liquidity ratios, and strategies. Stock generally has a smaller tick price compared to bonds or commodities because they trade at higher volume and require more precise pricing.

- Market Structure: The structure and participation in the market compel the exchange and regulatory bodies to frame tick price according to the need. Exchanges might set different tick price for different securities to bring balance between trading and increase precision as needed. Also, it is imposed to promote fair play in the trading game, Which can include tick price restrictions to improve market stability and protect investors.

Also Read: IEPF

Advantages of Tick Size

Improved Price Discovery: Smaller tick price reduces the gap between price fluctuations, allowing trailers to gauge the market price more precisely.

Enhanced Market Liquidity: An adequate tick price helps maintain a tighter bid-ask spread, making it easier for traders and investors to buy and sell assets without significant price changes.

Reduced Transaction Costs: Tighter bid-ask spreads lower the transaction cost for bulk orders, which is beneficial especially for intraday traders.

Fair Trading Practices: Standardization in tick prices across different securities maintains fair trading practices, protecting smaller investors from potential falls, by allowing them to sell and buy at their desired price.

Support for Various Strategies: Different tick price allows traders to experiment with different trading strategies, from high-frequency trading to long-term investing.

Regulatory Compliance: Adhering to tick price limits helps to ensure market compliance, which fosters investor trust and market integrity.

Disadvantages of Tick Size

Reduced Profit Margins: Increased tick price can significantly increase bid-ask spreads, reducing the profit margins for traders, this applies to traders particularly engaging in scalping or intraday.

Limited Price Precision: If markets have higher ticket prices, price movements become less precise which can hinder catching accurate price movements.

Impact on Liquidity: Market liquidity also decreases with increased tick price, making it hefty for traders to enter and exit positions.

Hindered Small Trades: A larger tick size isn’t favorable for small retailers, it becomes harder for them to match the pace of institutional traders who participate in the market with higher costs associated with wider spreads.

Inflexibility: Changing market conditions and fixed tick prices do not match, in periods of high volatility dynamic pricing is required.

Potential for Arbitrage: The differences in tick price across different markets or exchanges promote arbitrage opportunities for traders, which, while profitable for some, can bring inefficiency and unnecessary volatility into the market.

Conclusion

Tick size is an important factor in trading since it influences price discovery, liquidity, and transaction costs. Understanding the effects of tick size enables traders to make informed decisions, optimize their methods, and successfully manage risks. Smaller tick prices provide more exact pricing and lower trading costs, however, greater tick prices may limit liquidity and profit margins, especially for high-frequency and small-scale traders. Regulatory authorities, such as SEBI in India, change tick prices to balance market efficiency and stability, responding to market conditions and encouraging fair trading practices. By understanding the benefits and drawbacks of tick sizes in various markets and securities, traders can better traverse the complexities of the financial markets and capitalize on trading opportunities while avoiding associated risks.

Frequently Asked Questions

What is tick size in the stock market?

The tick size is the smallest price movement that can cause a security’s price to fluctuate. For instance, if the tick size is ₹0.01, the price can range from ₹10.00 to ₹10.01, ₹10.02, etc. It determines how prices are quoted and traded in the market.

How does tick size impact trading strategies?

Smaller tick sizes enable more precise pricing and narrower bid-ask spreads, which assist methods based on small price fluctuations, such as scalping and high-frequency trading. Larger tick prices, on the other hand, might widen bid-ask spreads, reducing profitability and increasing the cost of entering and exiting deals.

Why do regulatory bodies impose tick size requirements?

Regulatory authorities, such as SEBI, enforce tick size limitations to promote market stability, transparency, and fairness. Standardizing tick prices helps to avoid market manipulation and reduce volatility, and protect investors, fostering a stable and efficient trading environment.

How do tick sizes vary across different financial markets?

Tick sizes vary depending on asset class and market conditions. For example, higher-priced stocks often have greater tick prices, whereas highly liquid markets, such as Forex, have smaller tick sizes. Futures, options, and commodities markets all have variable tick widths based on their trading dynamics.

What are the advantages of having a standardized tick size?

Standardized tick sizes improve price discovery, increase market liquidity, and lower transaction fees. They also promote fair trading practices by allowing smaller investors to trade at reasonable pricing and supporting a range of trading techniques, which contributes to overall market integrity and efficiency.

Instagram

Instagram