Top Down Approach in Investing

- November 14, 2024

- 677 Views

- by Manaswi Agarwal

Top down approach in investing is a framework that helps investors and traders guide the price action of a stock. The market is volatile and uncertain; therefore the prices cannot be predicted in the stocks market. To understand the price of a stock, it is essential to study how it has performed previously. Top down approach efficiently describes the price action with the help of demand zones and supply zones.

What is the Top Down Approach in Investing?

Top Down approach is a strong technical analysis method through which investors recognize the price action of a stock from its start. This approach analyzes the overall journey of the stock which tells if the price has followed the respective supply or demand zones.

Multiple Timeframe Analysis

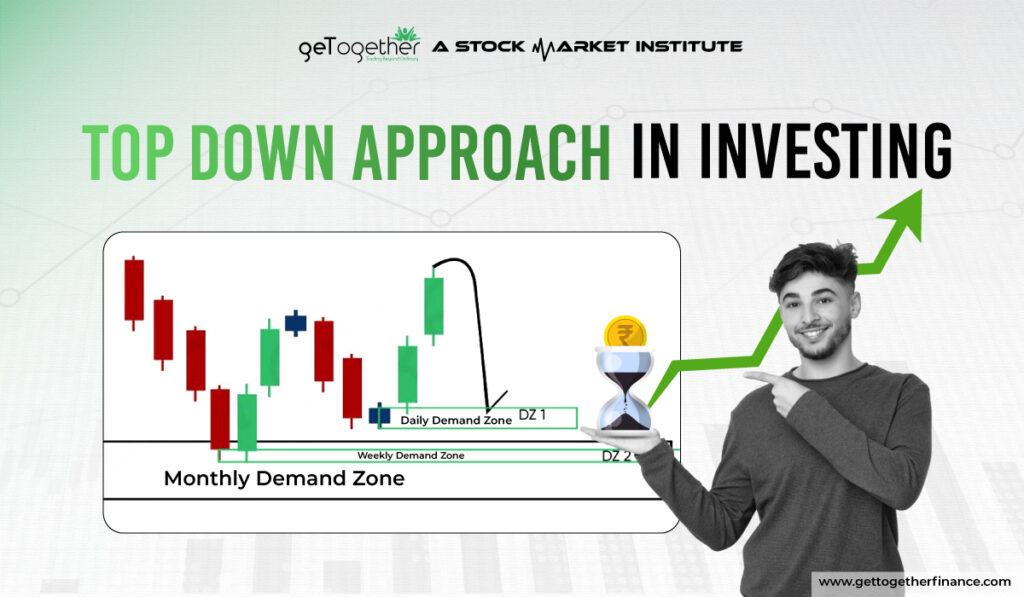

Top down approach is executed with the help of multiple time frame analysis methods. The multiple timeframe analysis is a framework which depicts analysis of price action on various time frames. The chart patterns are studies on different timeframes. The multiple timeframe analysis method is categorized into higher timeframe, intermediate time frame, and lower timeframe.

How does the Top Down Approach work?

The top down approach majorly works on the multiple time framework analysis. Investors or traders essentially follow a top down investing approach to make maximum profits. Top down approach is analyzing the charts on multiple time frames starting from the higher time frame and ending at the bottom. In a chart, an analyst can go through a yearly time frame to even a five minute or one minute time frame to analyze the price action of a stock.

Let us understand the technicals in depth, when we analyze the multiple time frames, we can observe if the price respects several demand zones or the supply zones. A trader can take the opportunity of trading at each newly formed demand zone. The demand zones of higher time frames are quite powerful to push the prices upwards. If the price is moving upwards from the demand zone of a higher time frame then the respective demand zones formed at a lower time frame are tradable.

The top down approach is a whole concept of multiple time frame analysis which consist of four major components that include higher time frame support, closing concept, sector support, and EMA crossover or trend analysis. It gives the confirmation to an investor about entry or exit points exactly through the charts.

Also Read: Sector Analysis

Factors affecting Top-Down Approach

Investors considers this as one of the most reliable approaches in technical analysis but somehow it also has to cope with the market factors in order to realize the investor’s expectation. Several market factors affect the working of top down approach of a stock either it might result in giving a pause in the prices or it might impact negatively in the short term.

Sector Support

The Top-Down approach is more powerful when the stock has a strong support of the sector. If the sector is moving in the opposite direction of the rotational cycle then it would drastically have an impact on the stock as well. Top down approach always works well with sector support as no barriers are left when the sector also supports the stocks.

Market Trend

Similar to the sector support, the stock also requires the support of market trends. The top down approach itself includes trend analysis; if the market is bullish showing an uptrend then the stock is supported positively to move in upwards direction.

Advantages of Top-Down Approach

Top down approach offers several advantages to the investors as it is useful to understand the price action of a stock. With the help of this, future prices can be predicted on a technical basis. Some of the advantages of using top down approach are given below:

Price Action

Top-Down Approach is beneficial to understand the price action of a stock on different timeframes. Investors or traders can analyze the future direction of stock prices through a top down approach.

Generates Maximum Returns

Investors can rely on a top down approach to get maximum returns as the demand zones of higher time frames are very powerful and have the strength to push the prices upwards.

Strong Technical Approach

The Top Down method is one reliable approach which briefly tells the price action of a stock. Investors can get the opportunity of buying the assets at lowest prices if the approach is used properly.

Final Thoughts

The Top Down approach is to analyze the price action of the stock from years to months or days. An analyst recognizes the action made by the stock according to the demand and supply theory at multiple time frame analysis. GTF offers a well built program which is the Trading in the Zone to help individuals learn the top down approach in detail.

FAQs

What is a top down approach in investing?

Top down approach in investing is a framework that is used by traders or investors to analyze the price action of a stock on multiple timeframes.

What is multiple timeframe analysis?

Multiple Timeframe analysis is studying the price action of a stock from higher timeframe to lower time frame according to demand and supply zones.

Is a top down approach good for investing?

Top down approach is one most powerful approach to study the charts on different timeframes. It gives a brief about the performance of a stock monthly, quarterly, weekly basis that helps to make investment decisions.

Instagram

Instagram