Inside the Rare but Powerful Triple Tops and Bottom Technical Analysis Patterns

- January 2, 2025

- 1102 Views

- by Manaswi Agarwal

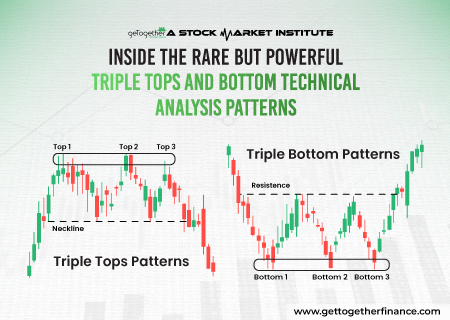

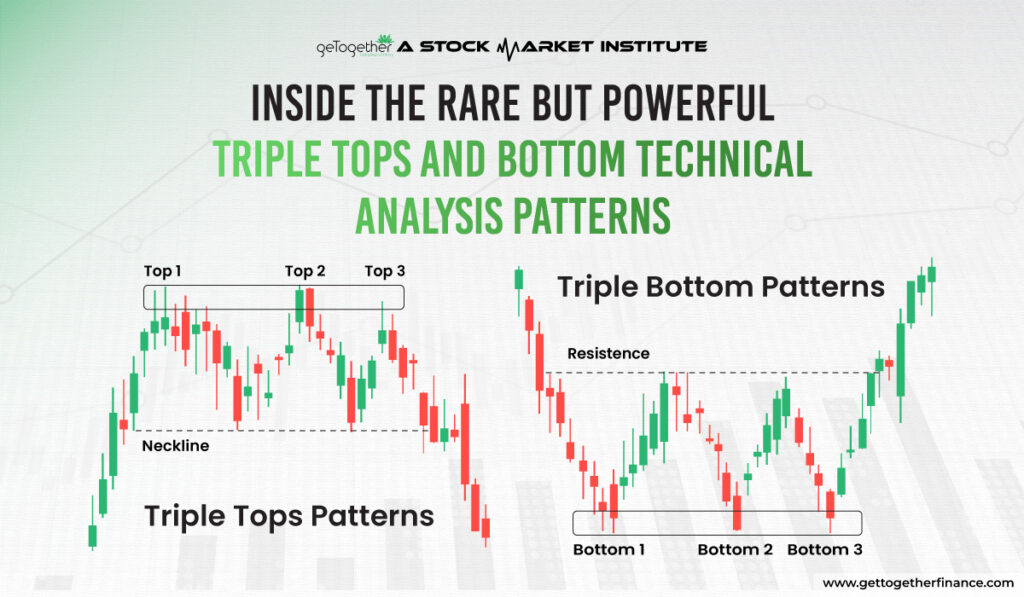

Active traders who regularly watch the market movement and analyze charts can only determine powerful triple tops and triple bottom patterns. These patterns are rare and hence observed less frequently than double top and bottom patterns. Triple tops and bottoms are similar to double tops and bottoms which determine bearish or bullish movement in asset prices.

Triple Top Pattern

Triple Tops and Triple Bottom patterns are the extensions of double top and double bottom patterns. The triple top formation in the candlestick chart is a representation of a bearish chart pattern. The triple top formation in the security hits the resistance with an uptrend that results in a change in the trend of the security towards downside.

How do Triple Top Pattern Forms?

In the triple top pattern, the price forms three consecutive peaks with two swing lows in between, it describes that the buyers are unable to penetrate the area of peaks. As the price falls below the support level, buyers tend to exit their long positions and traders jump into short positions.

Triple Tops patterns are traded once the price starts falling below the support level; it marks the entry point for traders to short their positions. If the price breaches the trend line and a further decline is expected in the prices, the downwards trend is confirmed with heavy volume.

Triple Top Pattern with Demand and Supply Theory

As per the demand and supply theory, when the demand zones are continuously breached by the prices with formation of new supply zones each time, then it is said that sellers are gaining control over the security. The action takes place when the price reaches the resistance level making three consecutive peaks and is pushed downwards by sellers.

Understand the price action by recognizing resistance level and uptrend, connect the lows that represent support level or neckline, the pattern is confirmed when the neckline breaks. Consider other important technical factors like volume, demand or supply zones that support your analysis.

Trading triple tops and bottom patterns without a demand and supply approach is highly risky as it does not allow you to manage your risk efficiently. Risk management is one essential factor which can be best supported by a demand and supply approach hence it is important to trade this based on this theory.

Triple Bottom Pattern

Triple Bottom Pattern is bullish in nature and represents an interruption in the downward trend of the security forming an uptrend. The three bottoms of the pattern signify unsuccessful attempts of the price to breach the support level with the continuation of the selling pressure. During the formation of three bottoms, the volume in the security continues to decline until the third bottom is formed.

Essence of Triple Bottom Pattern

The two swing highs formed between the three bottoms forms the resistance area. After the third bottom, sellers get exhausted and give the power to the buyers to change the trend and hence push the prices upwards breaking the resistance level.

Once the resistance level breaks, the upward trend is confirmed with a surge in the volume of the asset. Traders enter into long positions once the resistance level is breached by the traders and hence demand zones become active at each point. As per the demand and supply theory, in an upward trend, traders can trade each demand zone after the price breaks the resistance level.

Strength of Triple Tops and Bottom Pattern

Identification of triple top and triple bottom at the correct time proves very powerful and profitable. Some major benefits of trading with triple top and triple bottom pattern are as follows:

Strong Indicator of Trend Reversal

Both the patterns are the strong indicators of a clear trend reversal. Traders take the opportunity of trend reversal in the security and make their entry as soon as the trend line is breached.

Easy Identification

Though triple top and triple bottom are rarely formed on the chart pattern still the formation can be easily identified. Compared to other patterns, traders can easily spot the pattern by visually looking at the three peaks or three troughs at the same level.

Calculated Risks

When the price breaks the trend line, it provides a clarification to traders about appropriate entry or exit points in the asset. This also allows them to plot safe exit by setting stop loss orders above the resistance level in the triple top pattern and below the support level in the triple bottom pattern. Hence, the risk is managed with appropriate risk management measures and stop losses.

Drawbacks of Triple Top and Triple Bottom Pattern

Apart from the benefits that are offered by triple topd and triple bottom, there are certain risks that must be considered. Positive returns are not guaranteed by the chart pattern which is why a trader cannot depend solely on these patterns.

False Signals

The triple top or bottom patterns might give false signals of a breakout which goes back only to the previous trend to follow. The breakthrough resistance level might result in trapping you so you cannot completely rely on these patterns.

Market Sentiments

The movement in the security is affected by the market movements and during the volatility or complex conditions, the market might not behave as expected. Unexpected market fluctuation can give complete reversed results that can affect a trader’s portfolio negatively.

Subjectivity

Trading with a triple top and bottom pattern is quite subjective as each trader has a different opinion. Trading with patterns is always subjective in nature and hence is not reliable. This leads to inconsistent decision making as some traders might look at it as noise in the price action.

Wrap It Up

The formation of triple top or triple bottom signifies that the established trend is weakening and the other side is potentially gaining strength. However, the patterns can be relied on only when they work on the basis of demand and supply theory, top down approach, multiple time frame analysis, sector analysis as well as considering volume and other technical factors.

FAQs

Is a triple top pattern bullish or bearish?

Triple top pattern is a bearish signal as the prices reach the resistance level for the three consecutive times and the buyers are not able to breach the resistance level making the sellers active.

Is a triple bottom pattern bullish or bearish?

The triple bottom pattern represents a bullish move in the security as when the price reaches support level, the sellers start waning and the buyers become active by changing the trend of the asset.

How is a triple bottom different from a double bottom?

In triple bottom, the price tests the support level three times before breaking out and in double bottom the price tests the support level twice before breaking out.

What does the triple bottom indicate?

The triple bottom signals a reversal from a downtrend to an uptrend. It depicts the strength of the buyers which leads to a bullish move.

Can a triple bottom fail?

Yes, the triple bottom pattern can fail as there is no surety of the price moving in expected direction.

How do you confirm a triple bottom pattern?

A triple bottom is confirmed when the price breaks above the resistance level formed by the highs between the three lows.

Instagram

Instagram