Understanding Earning Per Share ( EPS )

Table of Contents

ToggleINTRODUCTION

Just imagine you are hustling through the stock market, where fortunes are made and lost in the blink of an eye, and where numbers have the power to make or break dreams. To make your stock investment journey easy we have created this blog which is precisely dedicated to Earning per share. Think of it as your friend who points you in the right direction when it comes to investment in stocks.

So without further ado let’s get right into the why’s and how’s of EPS.

Understanding Earning Per Share

Earning per share is a fundamental standard measure and a key component in the fundamental analysis used in the assessment of a company’s profitability before buying its shares, indicating how much it earns per share of common stock. It can be seen as a vital tool or indicator that reflects the company’s ability to distribute profits to its investors.

EPS plays an important role in comparing companies within the same industry or when evaluating their stock prices using the P/E ratio., It is determined by dividing the earnings available to shareholders by the average outstanding shares.

For example, let’s say two companies have the same number of shares, but one of them has a higher EPS. Higher EPS is a sign of a good investment option and a win-win situation which you will get to know later in the blog.

P/E RATIO- The P/E ratio stands for the price-to-earnings ratio, where P is the current stock price and E is earnings per share. Which is a standard way to figure out if a company’s stock price is overvalued or undervalued. It is like comparing the price of a share to how much a company makes for each share.

If the P/E ratio is high, it means the company is going to do really well in the future and vice versa.

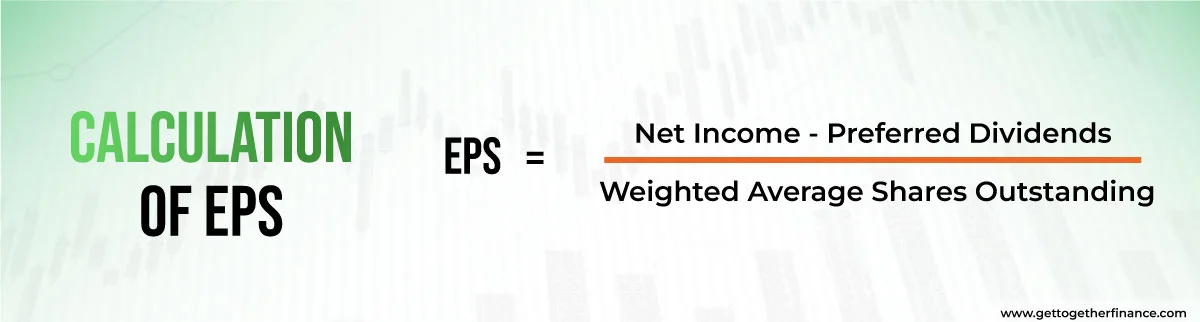

Calculation of Earning Per Share

Here’s how you can calculate earnings per share with this formula.

EPS= Net Income (without preferred dividends)/ Weighted Average of Outstanding Shares

Let’s try to understand this with an example

Let’s say a company ABC, has a net income of Rs.20,00,000, and it should also pay Rs.4,00,00 as a preferred dividend. It has Rs.8,00,00 common outstanding shares (weighted average).

Henceforth, the EPS of ABC company as per the earnings per share formula, must be

= Rs.1600000 /8,00,000

= Rs. 2 per share

The calculation of EPS varies as it depends on the type of earning, that has been used to achieve it, so it is important to be familiar with them in general.

Types of Earning Per Share

Generally, earnings per share is broadly categorized into four categories such as –

The calculation of EPS varies as it depends on the type of earning, that has been used to achieve it, so it is important to be familiar with them in general.

Basic EPS

Basic EPS only evaluate the number of outstanding common shares. It offers a simple perspective on a company’s profitability without examining the potential dilution from other securities.

Diluted EPS

Diluted EPS, on the other side, counts the potential dilution of earnings because of convertible securities such as stock options and convertible bonds. It offers detailed depth information and prediction of a company’s profitability.

Trailing EPS

Trailing EPS is generally calculated on the past year or last 12 months of earnings. It provides information about the company’s past performance.

Forward EPS

Forward EPS also goes by the name of projected or estimated EPS basically, it is like anticipating a company’s earnings for the future. It is a valuable resource for investors who are looking and trying to measure or predict a company’s growth potential.

Also Read: Inventory Management

BASIC EPS Vs DILUTED EPS

- Basic is a less complex and way too easy measure of assessing profitability of a company, which makes it more accessible to most investors. Whereas, Diluted EPS is way more complex or difficult for many investors to interpret and understand.

- Basic can fail to provide a realistic assessment of a company’s value, on the other hand, diluted EPS presents a more realistic picture by considering potential dilution.

- Diluted is a detailed measure of a company’s earning potential and helps prevent companies from hiding the potential dilution effect caused by issuing preference shares or convertibles.

- Calculating Diluted EPS can be a little bit complicated than basic EPS, as it involves additional data points like convertible preferred dividends and debt interest, and it is accountable for the impact of dilution from all convertible securities.

- Basic EPS is preferable for companies with easy or straightforward capital structures but on the other side Diluted EPS is preferable for larger companies with complex capital structures.

The dilution effect represents the decrement in existing stockholder’s earnings whenever a company issues more securities, which can be converted into shares like stock options, convertible bonds, or preferred stocks. It happens because the new securities issued by the companies potentially increase the total number of outstanding shares, which can lower the ownership and earning per share for existing stock holder.

Importance Of Earning Per Share

Earning per share is important for many reasons:

- As already mentioned above, it represents a company’s profitability and helps as an add on tool for fundamental analysis, specifically higher EPS indicates a possible increment in dividend.

- It assists in the comparison between different companies, mainly from the same genre, for the selection of more suitable investment options.

- It is used in fundamental analysis to predict a company‘s current and future stock value, helping in the assessment of its stock price and whether it aligns with market performance or not. The price-earnings ratio (P/E) is often used for this purpose, where E represents earnings that are derived from EPS.

- It also allows and helps in tracking a company’s past performance. A company with steadily increasing EPS is typically seen as a reliable investment, on the other hand, those that are inconsistent or have declining EPS over the years, may be less favored by experienced investors.

What Are The Factors Affecting Earning Per Share?

Earning per share can be influenced by several reasons:

- Whenever a company’s earnings shoot up, EPS also simultaneously goes up as there is more profit to distribute per share.

- You can see an increment in EPS if the company buys back some of its shares, resulting in a reduction in the total number of outstanding shares.

- Cost-cutting and lowering the company’s expenses can give a boost to the company’s earnings, especially when sales are on the rise.

- On the other hand, whenever a company issues, a new shares, such as rights or bonus issue, it can lead to a reduction in EPS, because the new securities issued by the companies potentially increase the total number of outstanding shares, which can dilute the ownership stake and EPS of existing stockholders.

Limitations of Earning Per Share

Although Earning per share is a useful financial tool, it has its own limitations:

- It can be easily manipulated by a changing accounting practices like recognizing revenue or delaying expenses and stock buybacks to appear more profitable in the short run, but this can lead to harm their long-term reputation and profitability.

- It tends to offer only a partial view of a company’s financial health, as it does not consider company’s debt. Also it have a tendency to ignore capital expenditure and the reinvestment in the business. A company can have high EPS, but if it fails to reinvest in its growth for future, than its not going to bore long term profit.

- It also tends to overlook cash flow, which is an important factor for assessing a company’s ability to repay its debt, which again makes it less effective for evaluating or assessing solvency.

- Macroeconomic factors like interest rate and inflation, have a significant impact on EPS. They can easily fluctuate EPS, as they vary over time.

While choosing stocks for investment, one should not solely rely on EPS and should incorporate other financial tools too as it’s not necessarily true that high EPS means is always a good investment.

If a company carries a high level of risk with high EPS one should analyze it thoroughly before investing, by incorporating other financial tools as well.

Conclusion

Earning per share is a standard way to measure how much a company earns for each of its shares of stock. Which is essential to estimate the company’s value. It is important to remember that Earning per share can be influenced by various factors whether it is net income, number of outstanding shares, or potential dilution. As an investor, knowing and understanding Earning per share and its trends can help you in making an informed decision about the stocks you are going to hold in your portfolio. It is just one piece of the puzzle and should be used by incorporating other financial indicators.

FAQs

What is earning per share?

Eps is a fundamental standard measure and a key component in the fundamental analysis used in the assessment of a company’s profitability. Indicating how much it earns per share of common stock. It can be seen as a vital tool or indicator that reflects the company’s ability to distribute profits to its investors.

How do you calculate earnings per share?

Here’s how you can calculate EPS:

EPS= net income – preferred dividends/ weighted average outstanding shares

What is the difference between basic and diluted EPS?

The key basic difference in basic and diluted EPS are :

Basic EPS is simpler and less complex measure of accessing profitability of a company. Whereas Diluted EPS might be more complex but provides detailed and realistic view of earnings, considering potential dilution.

Basic Eps is mostly preferred by easy or straightforward capital structure. On the other hand Diluted EPS is considered for larger with complex capital structure.

What is diluted earnings per share?

Diluted EPS, counts the potential dilution of earnings because of convertible securities such as stock options and convertible bonds. It offers detailed, in depth information and prediction of a company’s profitability.

How to Increase earning per share ratio?

Earning per share ratio can shoot up either by increasing net income or or by lowering the total number of outstanding shares. Accumulating or increasing expenses can leads to decreasing net income, whereas issuing more shares increases the number of outstanding shares.

Facebook

Facebook Instagram

Instagram Youtube

Youtube