Unlisted Shares Vs Listed Shares

Have you ever wondered how companies raise the funds they need to grow and innovate?

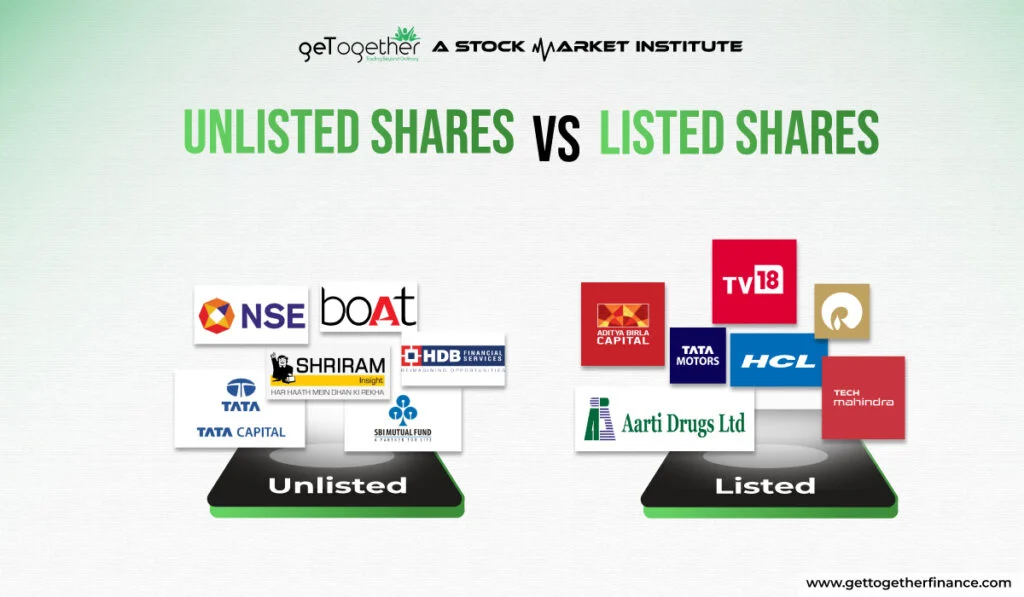

One way is by selling shares of ownership, essentially inviting investors to become part of their journey. These shares can be either listed or unlisted, each offering unique advantages and drawbacks.

Companies that set right with the SEBI criteria can be registered as listed companies and can become part of the global trading market. Whereas the ones that don’t fit right into the set criteria are known as unlisted companies.

This e-paper will unravel the key distinctions between listed and unlisted shares, empowering you to make informed investment decisions. Let’s get started.

Table of Contents

ToggleWhat Are Listed Companies

Listed companies act as the engines of the stock market, offering investors a platform and possibility to engage in the growth and success of established businesses. In technical terms, A listed company, also known as a publicly traded company, has gone through a formal process to list its shares on a stock exchange like the New York Stock Exchange (NYSE) or the Shanghai Stock Exchange (SSE). This listing process involves meeting strict requirements set by the exchange, ensuring a certain level of transparency and accountability.

As of 2023, there are over 50,000 publicly traded companies worldwide, according to the World Federation of Exchanges. Examples of listed companies are Tesla (TSLA), Alphabet (GOOG), Amazon (AMZN), and Apple (AAPL). Such companies play a vital role in. society by creating job opportunities and contributing majorly to economic growth.

Benefits of Investing in Listed Companies

Despite the fact that listed companies come under SEBI regulations and are governed under the set guidelines, there are several other benefits of investing in listed companies. Here, let’s take a look:

- Increased Capital Access: Listed companies raise significant funds for growth by selling shares to a vast pool of investors.

- Enhanced Liquidity: Listed shares trade on regulated exchanges, making it easier for investors to buy and sell compared to unlisted shares.

- Transparency and Credibility: Regular financial disclosures by listed companies build trust with investors and allow for informed investment decisions.

- Potential for Higher Returns: Listed companies offer the chance for significant returns through both share price appreciation and dividend payouts.

- Diversification Opportunities: Investing in a variety of listed companies from different sectors helps spread risk and potentially improve portfolio performance.

- Market Efficiency: Stock prices of listed companies tend to reflect their true value due to constant buying and selling activity, leading to a more efficient market.

- Potential for Voting Rights: Shareholders in some listed companies have voting rights, allowing them to influence certain company decisions.

What Are Unlisted Companies

The ones that work in the shadows are less prominent but can offer unique investment opportunities. Unlisted companies, also known as unquoted companies or private companies, are businesses that haven’t gone through the formal process of listing their shares on a stock exchange. They raise capital through various means, including:

- Debt financing (loans from banks and institutions)

- Venture capital (investments from specialized firms)

- Angel investors (wealthy individuals who invest in early-stage businesses)

- Retained earnings (profits reinvested back into the company)

Types of Unlisted Companies

- Private Companies: Such businesses are the ones that haven’t gone public yet and are typically owned by a small group of investors or founders.

- Pre-IPO Companies: This category considers companies that are preparing for an Initial Public Offering (IPO) to become listed on a stock exchange in the future.

- Government-Owned Enterprises (GOEs): These are businesses owned and operated by the government, and shares are not publicly traded.

Also Read: Share Delisting

Benefits of Investing in Unlisted Companies for Investors

Although it doesn’t seem like the face of the market or stock markets, there are several perks of choosing unlisted companies as your first choice of investment. Here we have listed a few benefits:

- High-Growth Potential: Unlisted companies, particularly startups and early-stage ventures, can offer the potential for high growth and significant returns if they succeed.

- Lower Investment Minimums: Compared to listed companies, the minimum investment amount in unlisted companies can be lower, making them accessible to a broader range of investors.

- Direct Investment Opportunities: Investors might have the chance to negotiate directly with the company or founders, potentially influencing decision-making.

- Focus on Long-Term Growth: Unlisted companies might be less pressured by short-term market fluctuations, allowing them to focus on long-term growth strategies.

Unlisted Shares Vs Listed Shares: The Difference

Listed shares and unlisted shares are two ways companies can raise capital by selling ownership stakes to investors. Here’s a breakdown of the key differences between them:

Trading Platform and Regulation:

- Listed Shares: Traded on stock exchanges like the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE) in India. These exchanges have strict listing requirements and regulations to ensure transparency and investor protection.

- Unlisted Shares: Traded over-the-counter (OTC) through private agreements between buyers and sellers. There’s no central exchange, and regulations are less stringent.

Liquidity:

- Listed Shares: Highly liquid because there’s a readily available market to buy and sell them. This makes it easier to enter and exit your investment.

- Unlisted Shares: Less liquid due to the limited number of potential investors. Finding a buyer for your unlisted shares can be challenging, and the selling process might take longer.

Investment Risk and Returns:

- Listed Shares: Generally considered less risky because of the regulations and transparency associated with listed companies. However, returns also tend to be lower due to the larger pool of investors.

- Unlisted Shares: Potentially higher risk due to the lack of regulations and limited information available. However, they also offer the possibility of higher returns, especially if the company is in a high-growth phase.

Investment Information:

- Listed Shares: Companies listed on stock exchanges are required to disclose a significant amount of financial information regularly. This information is readily available to investors for analysis.

- Unlisted Shares: Obtaining financial information about unlisted companies can be difficult. You might need to rely on the company itself or private networks for updates.

Investment Minimums:

- Listed Shares: You can often invest in listed shares with a minimum amount, even a single share depending on the company and the platform.

- Unlisted Shares: The minimum investment amount for unlisted shares can vary depending on the company and the agreement between the investor and the seller.

Unlisted shares Vs Listed shares

With the below content, you can easily differentiate the major distinction between both unlisted shares and listed shares:

| Feature | Listed Shares | Unlisted Shares |

| Trading Platform | Stock Exchange | Over-the-Counter (OTC) |

| Regulation | More Regulated | Less Regulated |

| Liquidity | High | Low |

| Risk | Lower | Higher (Potential for Higher Returns) |

| Information Availability | High | Low |

| Investment Minimums | Potentially Lower | Can Vary |

Remember: It’s crucial to do your due diligence before investing in any shares, whether listed or unlisted. Carefully research the company, understand the risks involved, and ensure the investment aligns with your financial goals.

Example of the Listed Companies in India

Here are a few examples of listed companies in India:

- Coal India

- Castrol India

- Maruti Suzuki India Limited

- Aegis Logistics Ltd

- Apollo Tyres Ltd

In A Nutshell

The stock exchange is not the complete face of the finance world such as listed companies and unlisted companies. If you want to begin your investing journey without expert assistance, it is essential to assess the characteristics and fundamentals of both, whether it’s listed or unlisted companies before investing. Remember – confidence in your research and investment decisions is more essential than investing in what’s popular. You can choose your investment preference, despite what everyone picks as long as you believe in your

FAQs

Can I take a loan from an unlisted company?

Getting approval for a loan request from an unlisted company is really difficult. Few financial instruments like ESOP financing offer financing against unlisted shares. However, most often, the loan requirements do not include delisted, unlisted, and many other investments.

How do unlisted companies make money?

Despite their mainstream business, both listed and unlisted companies raise capital through investments that support their growth and expansion plans.

How do you identify the shape price of unlisted companies?

Most online trading platforms provide information on the basic components of unlisted companies such as market cap, price, and the EBITDA score of the company. For example, 3A Deal, Enrich Advisors, Arms Securities, etc.

Can I sell unlisted shares after listing?

Absolutely! You can sell your unlisted shares during the lock-in period. The pre-IPO shares get a period of 6 months, known as the lock-up period from the date of listing. Once an IPO is announced, you can not sell your pre-IPO shares instantly, whether it is through a stock exchange or an unlisted broker. You must wait for six months of duration after the listing.

Facebook

Facebook Instagram

Instagram Youtube

Youtube