How to Use Demand and Supply Trading: A Beginner’s Guide

Overview

It’s easy to feel lost at first on how to use the many trading setups available. But among these, demand and supply trading stands out as a unique and powerful approach. Unlike traditional trading methods that exist, these trader techniques combine law of physics with market science.

Though, what exactly does demand and supply trading signify, and how does one effectively trade in it in order to build wealth ?

In this blog, we are going to have a simple step by step understanding of demand and supply. Finally, we are going to put together simple and effective strategies to use them for trading. Getting started, let’s find out.

What Is Demand-Supply Dynamics?

Demand-supply dynamics are the universal forces that influence price changes in different markets such as stock. Simply put:

- Demand is the willingness or desire of buyers to buy an asset at a particular price.

- Supply is the willingness or availability of sellers to sell an asset at that price.

Prices tend to rise, leading to bullish momentum, when demand is greater than supply. Vice versa, prices fall when supply is greater than demand, which fosters bearish momentum.

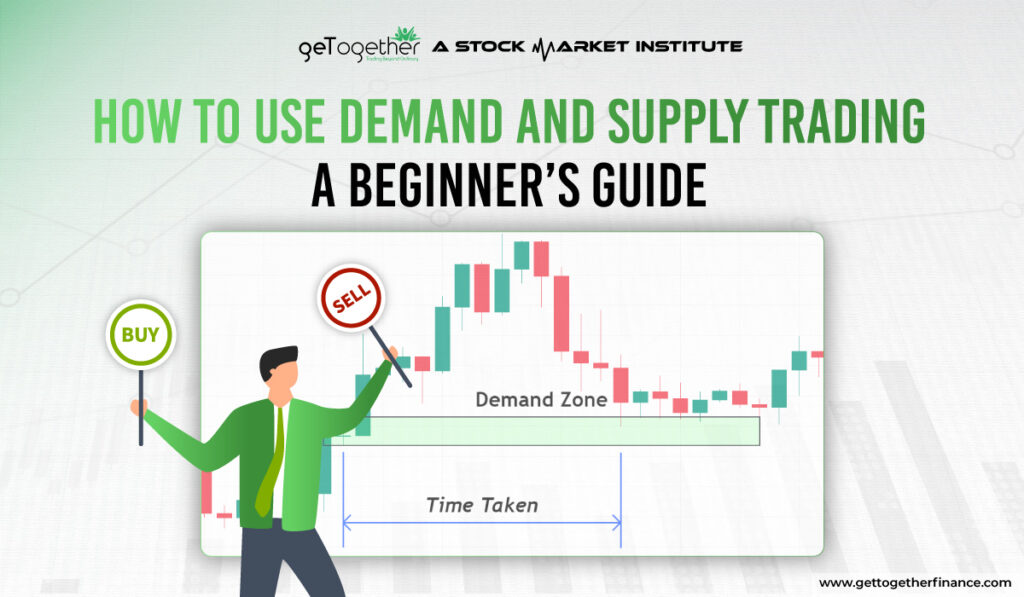

These shifts in prices allow us to identify sections on a chart that are highly likely to trigger a trend reversal or a trend continuation. These sections which traders use as reference points to enter or exit strategies with precision are usually termed as demand zones and supply zones.

But before we introduce demand and supply trading setup, it’s important to understand the fundamentals of demand and supply dynamics and structure of a candle. Let’s take a quick look at them

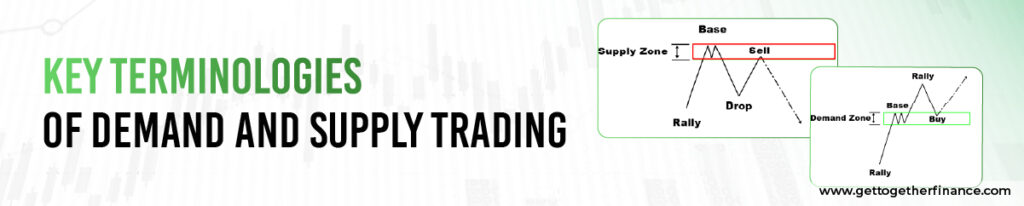

Key Terminologies of Demand and Supply Trading

Demand Zone: This is where buyers step in; they are the most influential players within this zone pushing prices to a higher level. A trader’s demand zone usually follows periods of pending buy orders in the system.

Try to picture a massive wedding bonanza themed buffet, where everyone is by the ice-cream table. Some price zones are like this buffet, a place where traders expect a lot of activity from buyers. Demand triggers when prices hit these levels, and prices recover back up like on a trampoline.

Supply Zone: A zone where sellers are in the driving seat and prices go lower.

Now put yourself near the end of the season sale where sellers are losing all hope to sell anything. Many sellers cluster around those price zones and the price moves down because of the increased supply.

Pending orders: These are the orders, which are still to be fulfilled, acting as a guiding factor for the market, creating either demand or supply zones.

How To Mark A Zone – Demand Zone & Supply Zone

To set up a trade using sheer demand and supply, first learn to identify a demand and supply zone.

The first step we will elaborate on is:

How to Mark a Demand Zone:

To find a strong demand zone, follow these steps:

- Add a horizontal line on the current market price

- Look over left and down for an explosive move (aka the very bullish (exciting) green candle)

- Now find all three components: LegIn, Base and Legout.

To draw a zonal structure, there are two fundamental methods for outlining a demand zone:

Body-to-Wick

- This is where you keep the proximal line on the highest wick of all base candles.

- Distal line is at the lowest wick of the base candles.

Wick-to-Wick

- Add a horizontal proximal line at the highest wick of all the base bull candles.

- Keep the distal line at the lowest wick of the base candles.

Steps to take when marking a supply zone that correspond with a demand zone:

How To Mark Supply Zone:

To find an exceptional supply zone, start with:

- Place a horizontal line at the current market price.

- After that, Look at left and up for an explosive drop (a big, exciting red candle)

- Obtain all 3 components: LegIn, Base, Legout

It is possible to mark out the areas of a supply zone in two simple ways:

Body-to-Wick

- Add a proximal on the lowest body of all base candles.

- Distal line will be on the highest wicks of all the bases.

Wick-to-Wick

- Ensure to draw a horizontal line on the lowest base wick.

- The distal line should be placed on the highest base wick.

Now that we have familiarised ourselves with the basics of marking a zone, let’s start developing a demand and supply trading strategy for you.

Demand and Supply Trading Setup

After marking out the demand and supply zones, the next step is preparing your trade setup. This explains the effective structure of trades:

Entry Points

For Demand Zone Trades (Long Position):

You should start your entry just above the proximal line of the demand zone. This represents that you are entering the trade as soon as buyers are ready to step in.

For Instance: When the proximal line of the demand zone is at ₹150, set your entry to ₹151.

For Supply Zone Trades (Short Position):

You should set your entry slightly below the proximal line of the supply zone. This gives you the opportunity to take advantage of selling pressure just as the price drops.

For Instance: When the proximal line of the supply zone is at ₹300, set your entry to ₹299.

Stop-Loss Placement

Refer your marked distal lines as your stop-loss point as it should help you avoid the risky price movements:

For Demand Zone Trades (Long Position):

Your stop-loss should be set just below the distal line of the demand zone. Leave a little space for potential noise.

For Supply Zone Trades (Long Position):

For a supply zone trade short position, set your stop-loss just above the distal line to ensure safety in case of an unexpected price breakout.

For example, if a distal line is set at Rs.320, the line can be secured at Rs.322. Similarly, if the distal line is set at Rs.140, the stop-loss can be placed at Rs.138, so that very minor fluctuations don’t change the trading level.

Target Setting

Target price should always correlate with a reward to risk ratio of 2:1. Following this target price needs to rest two times higher than the entry point minus the stop-loss.

If the stop-loss is placed at Rs.138, the entry point set at Rs.150, it gives you a Rs.12 margin, so the new target is flexible to Rs.174 after quickly adding the Rs.24 procurement cost.

Important Note: If a trade setup doesn’t provide better reward ratio (minimum 2:1), there is no need to act on a trade which holds minimal returns and greater risks.

Why This Setup Works

This method is foolproof approach as it ensures:

- You put a loss limit with a SL on the distal line.

- Moreover, the approach grants the perfect means to disciplined trade since you are only trading when there is a reasonable amount of profit expected.

Multiple Time-Frame Analysis in Demand-Supply Trading Setup

Trading is super interesting using supply-demand principles. But it becomes more powerful when clubbed with the Multiple Time-Frame (MTF) Analysis into your strategy as suggested by GTF Instructors.

MTF analysis allows traders to see the same asset in a different light by viewing it in different time zones. This makes it easier to identify stronger areas and confirm trends while also avoiding strategies that might jeopardize the trade.

Let’s understand how to use this approach effectively:

Why Use Multiple Time-Frame Analysis?

- Identify Major Trends: A broader trend can easily be identified using Higher time frames which reduces the chances of trading against market momentum.

- Confirm Demand-Supply Zones: Those zones that are present or aligned in multiple time frames tend to be stronger and more reliable.

- Refine Entries and Exits: Lower time frames can really assist you in enhancing your entry and exit points.

How to Club Multiple Time-Frame Analysis With Demand and Supply

Begin with using Top-down approach of studying a chart for a broader to smaller view:

Step 1: Analyze the Higher Time Frame (HTF)

Purpose: Determine the macro trend and identify stronger demand or supply zones on HTF.

Example: A daily or weekly chart can be used to ascertain whether the price is in an uptrend or downtrend market or if it is consolidating.

Key Action: Mark predominant zones of demand and supply on this time frame.

Step 2: Move to the Intermediate Time Frame (ITF)

Purpose: Validate the zones identified in the higher time frame and mainly confirm your trend on the intermediate time frame.

Note: If the market is sideways, ignore to enter in trade and wait for the market to confirm the next trend.

Step 3: Move to Lower Time Frames

Goal: An entry, stop loss, and target levels highly can be fixed here.

For instance: Find an exceptional demand or supply zone coinciding with the exceptional HTF zones. This will strengthen your trading set-up, making it max to impenetrable.

You can use below format to create a strong trading setup of demand and supply with multiple time frame analysis:

Tips For Using MTF Analysis with Demand and Supply Zones

- If a zone can be seen in several time frames, that means they are more powerful and are likely to work well.

- The trade is more likely to work if higher time frames are bullish and the price is retracing to a demand zone.

- Don’t trade against the trend in higher time frames.

- Use the lower time frame to provide you an entry slightly above the proximal line of the demand zone, or below the proximal line of the supply zone.

- Set the stop loss below or above the distal line as outlined above, keeping in mind proper risk management practices are in place.

Risk Management in Demand and Supply Trading

Trading is built upon risk management. Without sufficient risk management, all the strategizing would go to waste as a large amount would still be lost while trading. In this section we are going to look at how trading risk can be handled to determine size and level of positions to safeguard one’s capital.

Risk Per Trade Formula

The risk for each trade is the loss one is open to if the trade goes for the worse. To calculate the number of shares or quantity to trade, you can use the following formula:

Quantity = Risk Per Trade ÷ Entry Price (GP) – Stop Loss (SL)

How Much to Risk Based on Experience Level:

Ideally, a trader should manage their risk by keeping their position size only 1% of the overall investment. Here GTF segregated risk level based on expertise in market:

- Beginners: 1% total capital of allotted trading capital.

- Intermediates: 1.5% of allocated capital

- Pro Traders: 2%

Step-by-Step Example of Risk Allocation

Scenario

Capital: ₹1,00,000

Risk Level (Beginner): 1% of ₹1,00,000 = ₹1,000

Entry Price: ₹150

Stop Loss: ₹140

Risk Per Share: ₹150 – ₹140 = ₹10

Quantity to Trade:

Quantity = Rs 1000/10 = 100 Shares

This means 100 shares can be traded in this setup without risking more than Rs 1000 of trading capital.

Position Sizing

It’s basically a technique to manage your capital while trading. It helps you achieve the following:

- Determining Trade Size: According to the risk proportion above. Do not invest more than 1% of your capital standardly in each trade.

- Adjusting for Market Conditions: In times where the market is very volatile, it is advisable to lower your position size. This helps to avoid exposing yourself too much.

Key Takeaways for Risk Management:

- Stick to Your Risk Level: Make sure Never to risk more than the percentage of capital you resolved on.

- Avoid Overtrading: By setting limitations on the number of trades you can make, you are able to preserve your capital longer.

- Follow the Stop-Loss: Always respect your stop-loss to ensure early losses are kept to a minimum.

The Golden Rule Is: Never Risk It All

Always keep in mind that discipline pays the most. With proper risk and position size management, you don’t only have a fighting chance in the market, but also gain the potential for consistent profitability. After all, trading is a marathon and disciplined risk management makes sure you are always in the race.

Example of MTF, Risk Management with Demand and Supply

Let’s say you are analyzing a stock:

Daily Chart (HTF): Shows there is a demand zone around ₹500–₹520.

1-Hour Chart (ITF): A price retrace into the identified zone with a lot of selling momentum is confirmed.

15-Minute Chart (LTF): The price action shows a bullish engulfing pattern around the ₹515 level which is good for entry.

Trade Setup:

Entry: ₹516 (just above the proximal line).

Stop Loss: ₹505 (below the distal line).

Risk Per Trade: ₹1,000 (1% of ₹1,00,000 capital).

Position Size:

Quantity = ₹1,000/₹516 – ₹505 = 90 shares

Target: 2:1 Risk-to-Reward Ratio = ₹ 538

In A Nutshell

Trading in demand and supply is one of the most effective and easy techniques that allow traders to trade in and out of a market. Determining the locations where buying and selling thrive ensures that you preemptively avoid losses that the majority of traders suffer.

Using a broad range of tools like moving averages combined with multiple time-frame analysis, price-action analysis or even top-down approach, you can increase the effectiveness of your demand and supply trade setup. With enhanced understanding of market dynamics, these coupled with self disciplined risk management can lead to minimal losses and maximize gains regardless of if you are a novice, an intermediate or a professional trader.

But to learn more about the strategies above and how to use it practically, you can refer to the Trading in the Zone – Elementary Course available on Youtube for Free.

GTF also provides Lifetime Mentorship support and GTF indicator (automatically detects zones and more) to its students in the Trading in the Zone – Technical Analysis course which can be beneficial for someone looking for guidance while practicing.

FAQs

How do supply and demand zones differ from support and resistance?

Support and resistance are horizontal price levels, while supply and demand zones are areas with higher buying or selling pressure, often forming larger zones.

What is the significance of historical price data in understanding demand-supply dynamics?

Historical data helps traders identify patterns and trends that can be used to spot high buying zones and inform future trading decisions based on past behavior at specific price levels.

What is the Big Bull Approach?

Introduced by GTF, the Big Bull Approach focuses on leveraging demand-supply dynamics to make informed trading decisions, particularly by identifying undervalued stocks.

Instagram

Instagram