Basing: What it is, How to Identify it, Different Types

- December 31, 2024

- 937 Views

- by Manaswi Agarwal

Basing refers to price consolidation where an asset trades within a relatively tight range, forming a foundation for the next price movement. In technical terms, basing is a very important aspect to consider as it helps to predict the next price movements in a security.

Table of Contents

ToggleWhat is Basing?

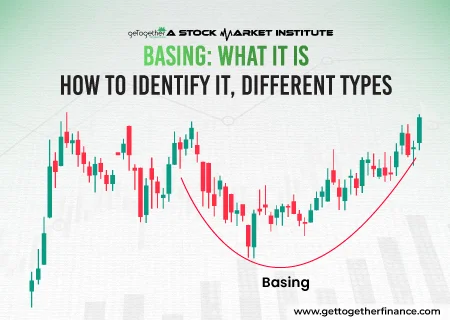

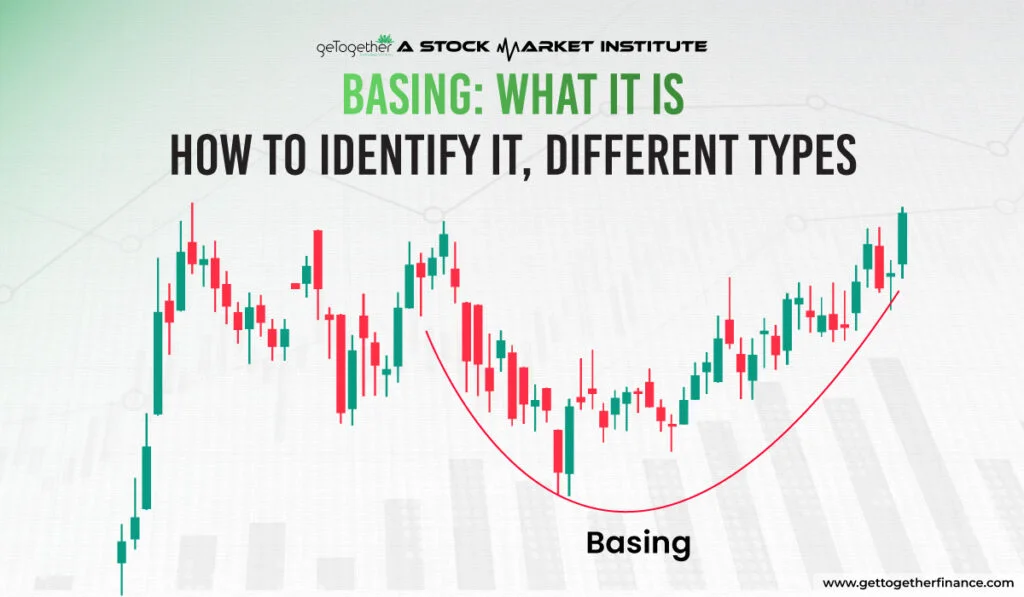

In trading terms, basing refers to the consolidation in the price of a security, usually after a downtrend, before it begins its bullish phase. The term is often used by technical analysts to make their analysis strong. It is defined as a consolidation period, basing is the phase where the prices of a stock, commodity or index stop following an ongoing trend and move sideways or horizontal.

How to find Basing in the Chart Pattern?

To know the basing period, there are some characteristics that needs to be followed by traders which includes:

Duration

When the price stays in the same range for a longer time period it is called the basing period. The time duration of a consolidation phase in the security can vary. It might last a few weeks to several months or even longer. It is also believed that the longer the basing period, the stronger the move is expected in the prices.

Trading volume

During the basing period, the trading volume is typically lower because of the uncertainty about the assets direction which often leads to reduced trading activity. A spike in the trading volume signifies the end of the consolidation period with the beginning of the new trend.

Technical tools

Basing period can be identified with the help of several technical tools such as support and resistance levels, moving averages and price action strategies.

An asset that follows the basing pattern establishes clear support and resistance levels as the bulls and bears fight for control.

What does Basing signify?

The sideways market represents a stable movement in prices of the security after a significant rise or fall and before the next price moves in either direction.

This period represents that the assets don’t make new highs or new lows as the security trades within a confined range because traders adjust their positions and make informed decisions based on recent price movements.

Stability

Basing is useful as it signals that the market has a balance between demand and supply. The price stability is a sign of positivity for investors after a period of volatility as it is less risky.

Prediction for Next Move

A consolidation period in securities is often followed by a significant price movement. The pattern formation helps traders to closely predict the future direction of the market if it will continue in the previous trend or will reverse.

Investment Opportunity

Investors have the opportunity to analyze and predict the performance of the security during the basing period and identify buy or sell opportunities. It gives the chance to traders to plan their next moves based on the security’s performance.

What are the Basing Trading Strategies?

Basing or the consolidation period must be detected properly in order to follow appropriate basing strategies:

Trend Continuation

The basing period determines an entry point in a trending market and should place a trade when the price breaks above the high of the consolidated range to make a long position. Traders can take the help of moving averages to identify the support at the bottom of the basing period and catch up to the price.

When the price moves in a narrow range, it offers a healthy risk-reward ratio as traders can place stop loss orders below the lowest traded price in the basing period for risk management.

Trend Reversal

The basing period is used to find potential bottoms or tops in a security. If the basing period lasts for an extended time, a breakout in the opposite direction to the previous trend often triggers stop-loss orders and attracts leaders in an environment that is conducive to a reversal.

Understanding Base-on-Base Patterns

Base on base pattern defines the combination of two bases which is a phenomenon that starts the base formation when an asset’s price does not reflect a substantial rise from its buy point. It is a signal of a basing pattern when a new base emerges at a point higher than the previous one which resembles two bases.

It can be seen how the base on base phenomenon is made out on the chart as it looks like the steps of a staircase. The second base is a flat base which includes a cup with or without a handle or they can be a double bottom.

Types of Basing

Basing can take various forms which must be identified by the technical analysts as it brings several opportunities for them:

Flat Base

Flat base represents a horizontal consolidation where price moves sideways within a tight range. It gives signals to traders about a pause before a potential breakout or breakdown.

Cup and Handle Base

Cup and handle chart pattern represents a rounded consolidation (cup) followed by a smaller consolidation which denotes the handle of the pattern. It signifies a strong continuation pattern in uptrends.

Ascending Base

Ascending base occurs with the consolidation pattern with a series of higher lows and relatively flat highs. This consolidation in the ascending base suggests accumulation and potential for a breakout to higher levels.

Double Bottom Base

In the double bottom base pattern, a “W”-shaped occurs where the price tests the same support level twice before breaking higher. It signals the reversal of a downtrend into an uptrend.

How to trade Basing?

In consolidation, patience plays a key role, the longer the basing period, the stronger move is. A trader has to wait for the breakout to enjoy the move. Let’s understand how to trade basing:

Watch for a Breakout: Enter the trade when the price breaks above or below a particular range. Make a long or short position respectively to enjoy the move outside the consolidated range.Set Stop Loss Order: Place the stop loss orders below or above the consolidation range as if the price reverses, a trader can end up making losses.

FAQs

What is a base in trading?

A base is a consolidation pattern where the price moves sideways within a defined range after a trend. It indicates equilibrium between buyers and sellers, often preceding a breakout in either direction.

How long does a basing period typically last?

A short term basing period may last for hours while a long term basing lasts for weeks, months or even years.

How do traders use basing in their strategies?

Traders use basing to enter positions when the price breaks out of the consolidation range and assess whether buyers or sellers are gaining control during the basing phase.

What are the different types of Basing?

The different types of basing includes: flat base, cup and handle base, ascending base, double bottom base, triple bottom base, rounded base, etc.

Can basing occur in any financial market?

Yes, basing can occur in any financial market, including stocks, forex, commodities, and cryptocurrencies.

How to identify basing phases?

Basing phases can be identified by bollinger bands, volume analysis and moving averages.

Instagram

Instagram