I recently took a GTF course, and I must say that I was thoroughly impressed with the content and structure of the course. The course started with basic concepts and theories related to markets and explains logic behind the movement of the price which we can correlate with real world situation. The lectures were engaging, easy to follow, and provided useful examples to illustrate the key concepts. Sooraj Sir is extremely knowledgeable and passionate about the subject. The course content were well-organized. After completing the course, I feel that I have a solid understanding of the dynamics of markets and how prices are determined. I was able to apply the theories and concepts learned to real-world situations and have enhanced my critical thinking and analytical skills. Overall, I highly recommend this demand and supply course to anyone looking to gain a deep understanding of markets and how they function. The course met and exceeded my expectations, and I feel that I gained a valuable understanding of the subject matter. I am really thankful to GTF team for this course.

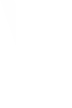

Trading In The Zone -Technical Analysis

This course is designed for those who want to become a Full-Time Trader and earn money by regular trading in the stock market.

How To Trade Like A Pro?

The course includes pure technical analysis with sector correlation, position size, risk management, wholesale/retail price, demand & supply, in-depth analysis on chart, advanced day trading strategy, how to read live price action, gaps, indicators, market traps, advanced stock scanning techniques, trading psychology, advanced trend analysis and much more. Specially designed for those who want to make a career in the stock market.

-

![img]() (3000+ Rating)

(3000+ Rating)

-

![img]() Hindi, English

Hindi, English

-

![img]() Stock Market Education

Stock Market Education

-

Trusted By 25,000+ Students

-

Trading In The Zone - Live Course

This course is designed for those who want to become full-time trader and earn money by regular trading in the stock market.

TRADING IN THE ZONE 2.0

Trading in the zone 2.0 is the next-level program without any additional cost for the existing GTF Family. The vision behind Trading in the zone 2.0 is to deliver everything we are exploring.

TRADING IN THE ZONE 2.0 EXTENDED

The next version of Trading in the zone 2.0 (Faster and Smarter).

Get Lifetime Mentorship support

Register Before Midnight Of 15 April 2025

To Unlock All Bonuses WorthRs 50,000

lifetime mentorship support

BONUS 1

lifetime access to advanced program trading in the zone 2.0

BONUS 2

lifetime access to advanced program trading in the zone 2.0 - Extended

BONUS 3

access to GTF indicator

BONUS 4

Access to private Group of Your Batch

BONUS 5

Lifetime Access to PDF Notes

BONUS 6

Free GTF Trader Checklist

BONUS 7

Bas Or Kya,Jaan Loge

PREMIUM CONTENT

What Will You Learn Over 20 Live Sessions?

-

Module 1

Making Your Foundation Strong

Why do we need Technical Analysis

Candlestick Explanation And Patterns

Importance of Price Action

Demand & Supply theory

-

Module 2

Your journey toward a rule-based trader

Trading on Multiple Time Frames

How to pick a perfect time frame based on your trading style

How to scan stock in the live market

Trend Analysis (Trading In The Zone Special)

Risk Management

How to Analyse a Sector to Find the blockbuster opportunity

![img]()

-

Module 3

Skills you need to become a pro trader in any market situation

When to be Aggressive or Conservative

Moving Average (Simple, Exponential, Linearly Weighted)

Algo Trader (How we can take advantage from them)

Market Traps

Trading against the Trend (Trading In The Zone Special)

-

Module 4

Finishing touch to make you a Disciplined Trader, GTF Trader

Conventional patterns V/s Demand & Supply

Gap Theory

Trading Indicators with Demand & Supply

Trading Psychology- How to overcome fear and greed (Trading In The Zone Special)

Journey of a Novice Trader to a Professional Trader

![img]()

Time is running out. Reserve your seat now!

Fee will increase by RS 2,000 once the timer Hits Zero

-

00

Hours

-

00

Minutes

-

00

Seconds

New to Stock Markets?

Get Started For Free With GTF

What Will You Learn Over 20 Live Sessions?

Our technical analysis course will teach you stock market technicalities to make informed trading decisions. Throughout the 20 live sessions, you'll learn to read and interpret between the lines using demand and trend theory, volumes, technical indicators, and candlestick strategies. Understand price actions, identify trading opportunities, and manage risk. Dive into real-time market analysis, build trading plans, back-test them, and adapt to failures (if any). Whether you're a beginner or an experienced trader, this course equips you for success.

Chart Types and Patterns

Demand and supply are the “Holy Grail” of stock market analysis. They offer a comprehensive pictorial view of price movements to help you predict stock market behavior effectively and make accurate predictions. Our technical analysis course covers various chart patterns, including demand and supply zones and candlestick chart patterns. The comprehensive handbook will help you recognize trends, reversals, and consolidation phases so that you can time trades, set stop-loss levels, and target price objectives better.

Technical Indicators

Technical indicators are graphical patterns derived from a stock's historical data that help you determine its future price movements. This stock market analysis course common technical indicators, including RSI, EMA, and Stochastic. Use our free charting feature to experiment with multiple patterns. Learn how to use these indicators to make informed decisions, spot entry-exit points, and manage risk effectively

Support and Resistance

Support and resistance are two of the most significant concepts of technical analysis. The content of our technical analysis course is elaborate enough that yo'll learn a tremendously powerful trading framework from its very basics to complete use in live market conditions. Trade breakouts and breakdowns using support and resistance. Perfect the entries and exits in different market trends. Avoid mistakes that most stock market traders commit at all times.

Technical Analysis Strategies

We empower traders and investors with innovative technical analysis strategies to succeed in the stock markets. Unleash the power of technical indicators and turn them into your compass in the complex trading sea. Understand how to spot and analyze critical chart patterns using visual cues for strategic trades. Sharpen your market interpretation abilities through price-action patterns. Explore real-world case studies and interactive quizzes for a hands-on experience.

Risk Management and Trading Psychology

Effective risk management and strong trading psychology are the cornerstones of successful trading in the dynamic world of stock markets. At Get Together Finance, we offer expert-led courses that enable you to navigate the markets with confidence.

Our technical analysis course modules cover vital topics such as position sizing, stop-loss strategies, and emotional discipline. Learn to identify, assess, and mitigate risks effectively, ensuring your capital remains protected. We help you develop a solid risk management plan while enhancing your mental resilience in the face of market fluctuations.

eligibility

Who Is This Course For?

BEFORE YOU ASK

Yes! You Will Be Certified For This Course

GTF - A Stock Market Institute

Certificate

---------- Of Completion ----------

INSTRUCTOR SIGNATURE

GRAB THE COMBO

COMBO (TRADING IN THE ZONE + GTF OPTIONS)

if you have not completed trading in the zone, here is a combo offer

The course includes pure technical analysis with sector correlation, position size, risk management, wholesale/retail price, demand & supply, in-depth analysis on chart

-

![money-send]() Fees Charges

Fees Charges

40000+GST

-

![money-send]() Total Charges

Total Charges

47,200

40000+GST

FAQ

Here's everything you may ask...

The total duration of the course would be of 1 month which includes, 20 sessions. Classes will be held from Monday to Friday.

Trading in the Zone is the mandatory course to do if you want to opt for the options course.

Trading in the Zone course includes a wide range of topics such as Demand & Supply Theory, how to read price action, sector correlation, risk management, trading psychology, gap theory, advance trend analysis, and many more.

Yes, you can opt for both the courses together. We have an option for the combo course in which you will get a discount of 10000rs on your fees and after the discount, it will be 40000 + GST in total 47200/-

Yes, of course, you will get the recordings of Live sessions and after completion of your course, you will be having the access to recorded sessions for the next 3 months.

In this course, you will get: 1. Lifetime Mentorship Support 2. Private Telegram group access 3. Access to our premium programs 4. Notes & Checklist

Yes, you will get Mentorship Support for a lifetime.

Yes, you will get access to premium programs just after enrolling in the course.

At the initial stage, we do not recommend you to start trading but, after the completion of the 10th session, you can start trading according to your risk management.

After completion of the Trading in the Zone course, you can download the Certificate from our Website/Application.

Among the best technical analysis courses, Get Together Finance stands as a promising option. Geared toward beginners, investors, and traders (part-time/full-time), our courses help you get started or master specific concepts like risk management, market traps, and trend analysis. GTF is now almost a decade old, and its experience is evident in the quality of training and feedback from over 25,000 students.

A technical analysis course trains people to examine stock markets and make trading decisions based on historical price charts and statistical data. This course teaches students to identify various technical indicators like patterns, trends, support and resistance levels. They deep dive into market psychology and use these tools to predict future price movements in stocks, commodities, or other financial instruments.

Technical analysis in the stock market involves evaluating and anticipating how a stock’s price will behave in the future based on historical volume and price. Traders monitor three types of trends: uptrend (prices increase), downtrend (prices decrease), and sideways (prices move within a range).

To learn technical analysis, start with educational resources like online courses, books, and workshops. Understand how to study charts, patterns, and technical indicators. Practice on virtual trading platforms to gain hands-on experience. Join trading communities to exchange experience and knowledge and continuously practice to refine your skills. At Get Together Finance, we offer comprehensive courses, coupled with experienced mentors, to ensure that you become an expert and confident stock trader. You will unlock lifelong access to advanced program trading in the zone, PDF notes, and GTF indicator by enrolling in our stock trading courses.

In technical analysis, traders look at a stock's historical price and volume data to anticipate its future price movements. They study demand & supply zones, conventional patterns, charts, and technical indicators (moving averages, relative strength index, and on-balance volume) to determine support and resistance levels and potential entry and exit points. Typically, technical analysis is suitable for short to medium-term returns as well as long terms investment. In fundamental analysis, investors determine a stock’s value by examining various financial and economic factors. These include a company’s fundamentals like revenue, profit after tax (PAT), and management’s competency. Fundamental analysis in the stock market is ideal for long-term returns.

In technical analysis, traders examine a stock’s price action based on demand - supply, historical price and volume data, spot patterns, and use technical indicators. They look for trends, support and resistance levels, and chart patterns to predict where the price will move in the future. By recognizing repetitive patterns and market sentiment shifts, traders identify entry and exit points, set stop-loss orders, and manage risk.

Follow these steps to perform technical analysis in the Indian stock market:

- Pick the stock you want to analyze.

- Build and analyze price charts to spot trends, support, and resistance levels.

- Mark demand and supply zones to understand price action.

- Apply technical indicators to gain additional insights into market conditions.

- Look for chart patterns like reversal or continues patterns of demand and supply, trend lines for potential trend reversals or continuations.

- Analyze the sector's chart to understand price movements to catch valuable signals.

- Use multiple timeframes (daily, hourly, 75/125 minute or 15-minute) to dig deeper into market trends.

- Do top-down approach and high time frame analysis to understand price actions of stocks.

- Set stop-loss and take-profit levels to manage risk and protect your capital.

Related Courses

Trading In The Zone -Technical Analysis Course (Recorded + Live QNA)

Stock Market Education

₹ 10000